Regulatory Framework Enhancements

The evolving regulatory landscape in Spain is playing a crucial role in shaping the protein therapeutics market. Recent reforms aimed at expediting the approval process for innovative therapies are likely to encourage the development and commercialization of new protein-based treatments. The Spanish Medicines Agency has implemented measures to streamline clinical trial approvals, which could reduce the time to market for new therapeutics. This supportive regulatory environment is expected to foster innovation and attract investment in the protein therapeutics sector. As a result, the market may experience accelerated growth, with projections indicating an increase in new product launches by 15% over the next five years, thereby enhancing the overall therapeutic options available to patients.

Rising Public Awareness and Education

Public awareness regarding the benefits of protein therapeutics is steadily increasing in Spain, which is positively impacting the market. Educational campaigns and outreach programs are informing patients and healthcare professionals about the advantages of biologic therapies, including their efficacy and safety profiles. This heightened awareness is likely to lead to greater acceptance and utilization of protein therapeutics in clinical practice. As patients become more informed about their treatment options, the demand for these therapies is expected to rise. Market analysts suggest that this trend could contribute to a 12% increase in the adoption of protein therapeutics over the next few years, thereby reinforcing the market's growth trajectory.

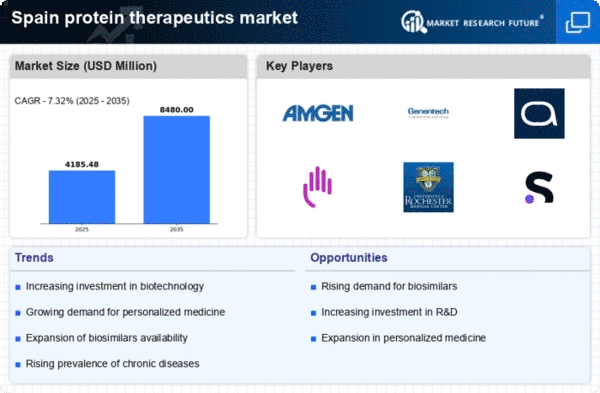

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in Spain is a pivotal driver for the protein therapeutics market. Conditions such as diabetes, cancer, and autoimmune disorders are becoming more prevalent, necessitating advanced treatment options. According to recent health statistics, chronic diseases account for approximately 70% of all deaths in Spain, highlighting the urgent need for effective therapies. This growing patient population is likely to propel the demand for protein therapeutics, particularly monoclonal antibodies and recombinant proteins, which are increasingly recognized for their efficacy. As healthcare providers seek innovative solutions to manage these conditions, It is expected to expand significantly, with projections indicating a growth rate of around 8% annually over the next five years.

Growing Investment in Personalized Medicine

The shift towards personalized medicine is significantly influencing the protein therapeutics market in Spain. As healthcare moves towards tailored treatments based on individual genetic profiles, the demand for specific protein therapeutics is likely to increase. This trend is supported by the Spanish government’s initiatives to promote research in genomics and biotechnology, with funding allocations reaching €300 million in recent years. Personalized therapies, particularly those involving protein-based treatments, are expected to enhance patient outcomes and reduce healthcare costs. Consequently, the protein therapeutics market is poised for growth as pharmaceutical companies develop innovative solutions that cater to the unique needs of patients, potentially increasing market share by 10% over the next decade.

Advancements in Biomanufacturing Technologies

Technological advancements in biomanufacturing are transforming the protein therapeutics market in Spain. Innovations such as continuous manufacturing and improved cell culture techniques are enhancing the efficiency and scalability of protein production. These advancements not only reduce production costs but also improve the quality and consistency of therapeutic proteins. As a result, pharmaceutical companies are increasingly investing in these technologies to meet the growing demand for biologics. The Spanish biopharmaceutical sector is witnessing a surge in investment, with estimates suggesting that the market could reach €5 billion by 2027. This trend indicates a robust future for the protein therapeutics market, driven by enhanced manufacturing capabilities and the ability to deliver high-quality therapies to patients.