Spain Property Insurance Market

Spain Property Insurance Market Size, Share and Research Report By Insurance Type (Homeowners Insurance, Renters Insurance, Condo Insurance, Flood Insurance, Earthquake Insurance), By Coverage Type (Actual Cash Value, Replacement Cost, Extended Replacement Cost, Guaranteed Replacement Cost), By End Use (Residential, Commercial, Industrial) and By Distribution Channel (Direct Sales, Brokerage, Online Platforms, Banks)- Industry Forecast Till 2035

Spain Property Insurance Market Overview

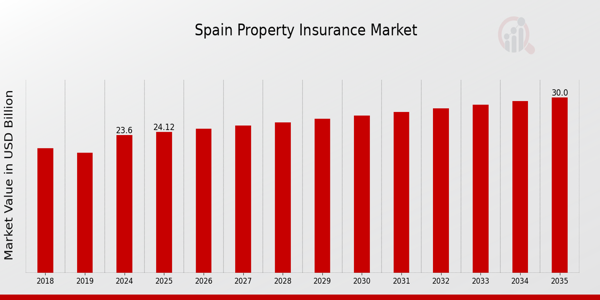

As per MRFR analysis, the Spain Property Insurance Market Size was estimated at 22.85 (USD Billion) in 2023.The Spain Property Insurance Market is expected to grow from 23.6(USD Billion) in 2024 to 30 (USD Billion) by 2035. The Spain Property Insurance Market CAGR (growth rate) is expected to be around 2.205% during the forecast period (2025 - 2035).

Key Spain Property Insurance Market Trends Highlighted

In Spain, the property insurance market is experiencing several important trends driven by various factors. One key market driver is the increasing number of natural disasters, such as flooding and wildfires, which have led to a heightened awareness among homeowners about the necessity of adequate insurance coverage. The government has also been implementing measures to address climate change impacts, motivating consumers to seek insurance products that offer better protection against environmental hazards.

Additionally, the rising property prices in urban areas have compelled individuals to secure insurance that reflects the true value of their assets, driving demand for more comprehensive coverage options.As insurance companies change to meet the needs of their customers, new opportunities are opening up in the market. Companies are using digital solutions to improve customer service and speed up the claims process as technology has improved.

Smart home technology is also opening up the possibility of insurance products that give discounts to homes that have safety and monitoring systems. Another way to grow is to target young homeowners with policies that are made just for them. This group of people is becoming more interested in owning property. Recent trends show that people want insurance policies that are flexible and can be changed to fit their needs.

There is also an increasing preference for eco-friendly insurance options that promote sustainable practices. The demand for quick and efficient online services has also gained momentum, encouraging insurers to invest in digital platforms and mobile applications. As the market in Spain continues to evolve, these trends reflect the changing landscape of property insurance and the dynamics shaping consumer behavior in the region.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Spain Property Insurance Market Drivers

Increasing Property Ownership in Spain

The growing trend of property ownership in Spain is a significant driver for the Spain Property Insurance Market. According to the Ministry of Transport, Mobility and Urban Agenda, home ownership rates have been rising steadily, with approximately 76% of the population owning their homes in recent years.

This increase in property ownership correlates with a growing demand for property insurance services, as homeowners seek to protect their investments.Established companies in the market, such as Mapfre and Allianz, are positioning themselves to capitalize on this trend by offering tailored insurance products to residential property owners. This uptick in property ownership directly influences the market's growth potential from 2025 to 2035, reinforcing the need for adequate property insurance solutions.

Rising Natural Disaster Incidences

Spain has been experiencing an increase in natural disasters, such as floods and wildfires, which propels the demand for property insurance coverage. The Spanish Government has reported that flooding incidents have risen by approximately 30% over the past decade, impacting thousands of homes and prompting homeowners to seek insurance.

These figures have led major insurers, such as Generali and AXA, to enhance their risk assessment models and offer more comprehensive coverage options.As climate change contributes to more frequent and severe weather events, the urgency to secure property insurance is heightened, driving continued growth in the Spain Property Insurance Market.

Enhancements in Digital Insurance Platforms

The adoption of digital technologies in the insurance sector is transforming how policies are sold and managed, and Spain is seeing significant advancements in this area. Insurance providers are increasingly investing in digital platforms for user-friendly policy management and claims processing.

According to a report by the Spanish Insurance Association, over 50% of insurers are offering online services to enhance customer experience. Companies like Zurich Seguros are leveraging these advancements to reach a broader audience, streamline operations, and attract tech-savvy consumers.The digital transformation is likely to promote increased competition and innovation within the Spain Property Insurance Market, thereby fostering growth.

Government Incentives for Property Insurance Uptake

The Spanish government has implemented various initiatives to encourage the uptake of property insurance. For instance, the implementation of the National Risk Plan has highlighted the importance of protection against property losses due to natural disasters. In recent years, official reports have shown a 20% increase in citizens purchasing property insurance after awareness campaigns.

The government, along with bodies like the Insurance Compensation Consortium, has been pivotal in ensuring policyholders understand the benefits of insurance.This supportive climate enhances trust in the insurance market and drives growth within the Spain Property Insurance Market as more individuals recognize the necessity for property insurance coverage.

Spain Property Insurance Market Segment Insights

Property Insurance Market Insurance Type Insights

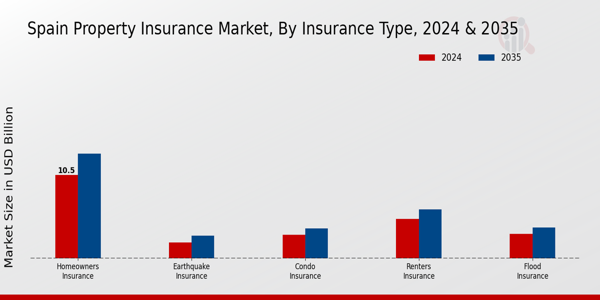

The Spain Property Insurance Market shows a strong emphasis on the Insurance Type segment, where various forms of coverage cater to different homeowner needs and preferences. Homeowners Insurance holds a significant position in the market due to the increasing awareness among property owners regarding potential risks, such as theft, natural disasters, and liability claims. Renters Insurance is also noteworthy, gaining traction as more individuals choose to rent rather than buy property, providing protection for personal belongings against damage and theft, making it an essential option for a large demographic of renters in urban areas of Spain.

Additionally, Condo Insurance has emerged as an essential segment, especially in cities with a high number of condominium developments, ensuring homeowners are covered for liabilities and damages within shared spaces. Flood Insurance has gained particular relevance in Spain, especially in areas prone to climate change impacts, enabling property owners to protect themselves from financial losses associated with flooding incidents. Meanwhile, Earthquake Insurance is increasingly prioritized owing to the geographical nature of Spain, which experiences seismic activity; thus, this type of coverage offers essential security for both homeowners and renters alike.

Overall, the diverse offerings within the Insurance Type segment reflect significant adaptation to market needs, fostering a sense of security in an ever-changing environment. The ongoing growth in the Spain Property Insurance Market is largely fueled by heightened awareness of the importance of these insurance products, aligning with the necessity to safeguard valuable property assets.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Property Insurance Market Coverage Type Insights

The Spain Property Insurance Market is significantly influenced by the Coverage Type segment, which plays a crucial role in determining the extent of protection offered to property owners. Coverage types such as Actual Cash Value and Replacement Cost are fundamental, as they cater to diverse consumer needs and preferences. Actual Cash Value typically involves compensating the insured for the depreciated value of property, making it an appealing choice for budget-conscious individuals.

Conversely, Replacement Cost coverage provides the necessary funds to replace a property at current market prices, reflecting a growing demand for comprehensive protection among property owners in Spain.Extended Replacement Cost and Guaranteed Replacement Cost further enhance the offering by ensuring that the policyholder is compensated for rebuilding costs that may exceed the initial valuation, addressing concerns of inflation and rising material costs in the construction sector.

These coverage types are vital not just for individual property owners but also play a significant role in improving risk management strategies amidst natural disasters that are fairly common in Spain, thus ensuring a fortified real estate sector and contributing to the overall robust growth observed in the Spain Property Insurance Market.This emphasis on varied coverage types aligns with the emerging trends in the property insurance landscape, where consumers seek more tailored insurance solutions that cater to their specific scenarios.

Property Insurance Market End Use Insights

The Spain Property Insurance Market, particularly in the End Use segment, exhibits a diversified landscape catering to the various needs of property owners across different sectors. The market encompasses essential categories such as Residential, Commercial, and Industrial, each contributing significantly to the overall growth and dynamics of property insurance. The Residential segment is crucial as it provides coverage for homeowners, fostering a sense of security amid a growing population and increasing property values throughout Spain.

Commercial property insurance plays a vital role in supporting businesses, ensuring continuity and security amid evolving market conditions, while the Industrial segment addresses the complex risks associated with manufacturing and production sites.The robust urban development and significant investments in infrastructure, such as in major cities like Madrid and Barcelona, reinforce the necessity for comprehensive insurance solutions across these segments. As the Spain Property Insurance Market experiences steady growth, understanding the various End Use applications will be instrumental in shaping future offerings and responding to emerging trends in risk management.

Factors such as the need for enhanced coverage options and the rise in environmental concerns are likely to influence the strategies within this segment, paving the way for new opportunities and advancements in insurance solutions.

Property Insurance Market Distribution Channel Insights

The Distribution Channel of the Spain Property Insurance Market plays a vital role in facilitating consumer access to various insurance products. This segment comprises several key avenues including Direct Sales, Brokerage, Online Platforms, and Banks, each contributing uniquely to the overall market dynamics. Direct Sales enable insurance providers to engage with customers directly, enhancing personalized service and fostering trust. Brokerage channels act as intermediaries, allowing consumers to compare different policies effectively and aiding them in making informed decisions.

Online Platforms have gained prominence, particularly among the tech-savvy population, offering convenience and instant access to quotes and policy details, which is becoming increasingly important in the digital age. Meanwhile, Banks serve as a significant distribution channel, integrating property insurance offerings into their financial services. The growing emphasis on digitalization in Spain is reshaping how these various distribution channels operate, with an increasing adoption of technology, thereby enhancing customer experience.

Factors such as changing consumer preferences, regulatory developments, and the competitive landscape are driving the evolution of these distribution methods, highlighting their critical importance to the Spain Property Insurance Market Statistics and overall growth trajectory.Through a comprehensive understanding of the different distribution channels, stakeholders can better navigate the complexities of the Spain Property Insurance Market segmentation and ensure they meet diverse consumer needs effectively.

Spain Property Insurance Market Key Players and Competitive Insights

The Spain Property Insurance Market remains dynamic and competitive, driven by various factors including evolving consumer demands, technological advancements, and regulatory changes. Insurers are continually adapting to shifting market conditions and customer expectations, which have led to innovations in policy offerings and pricing strategies. The interplay between established players and new entrants fosters a competitive landscape where companies must focus on enhancing customer experience, optimizing distribution channels, and leveraging data analytics for better risk assessment.

With increasing awareness around property risks, including natural disasters and fire hazards, the market is witnessing a surge in demand for tailored property insurance solutions that cater to both residential and commercial sectors.Zurich holds a significant position in the Spain Property Insurance Market, capitalizing on its strong brand reputation and extensive distribution network.

The company is known for its customer-centric approach and offers a diversified portfolio of property insurance products tailored to meet the needs of Spanish consumers. With a focus on innovation, Zurich has been able to integrate technology into policy management and claims processes, thereby improving operational efficiency and customer service. Its strengths lie in its proficient risk management practices and its ability to provide flexible coverage options that cater to a wide range of clients.

As a well-established player, Zurich's presence in Spain is marked by its commitment to providing reliable insurance solutions while adapting to the changing risk landscape inherent in the market.Generali is another prominent name within the Spain Property Insurance Market, recognized for its comprehensive range of insurance products that include home, tenant, and property owners' insurance. The company has established a robust market presence due to its strong distribution channels and customer loyalty.

Generali's core strengths include its analytical capabilities in assessing risk and designing products that align with consumer needs, providing valuable coverage in an uncertain environment. The company remains proactive in pursuing strategic partnerships and mergers that enhance its market capacity and expand its service offerings. Through continuous investments in technology, Generali improves its product accessibility and simplifies the insurance experience for customers in Spain. Overall, Generali not only focuses on traditional property insurance offerings but also adapts to emerging trends that are shaping the future of the insurance market in the region.

Key Companies in the Spain Property Insurance Market Include:

- Zurich

- Generali

- HNA

- Reale Seguros

- Santalucia

- Mapfre

- Grupo Catalana Occidente

- Seguros Solis

- Axa

- Liberty Seguros

- Allianz

- Caser

- DKV Seguros

Spain Property Insurance Market Developments

Recent developments in the Spain Property Insurance Market indicate growth and significant activity among major companies. In September 2023, Generali acquired a regional insurance firm, enhancing its market presence in Spain, while Zurich reported a rise in premium income for the Q2 2023 period, indicating increasing consumer confidence. Meanwhile, Mapfre has been enhancing its digital offerings to improve customer engagement and streamline claims processes, reflecting a trend towards digitalization in the sector.

The HNA Group has also been focusing on expanding its property insurance products tailored for the Spanish market, aiming at younger consumers. In the last few years, Allianz launched new tailored solutions in July 2022, targeting the needs of homeowners, and DKV Seguros made strides in promoting eco-friendly insurance options in October 2021.

The growth in market valuation, alongside rising claims due to natural disasters, has pressured insurers to re-evaluate their risk models. The overall enhancement in customer service and product offerings signifies a competitive environment within the Spain Property Insurance Market, with companies like Santalucia and Grupo Catalana Occidente also actively participating in this dynamic landscape.

Spain Property Insurance Market Segmentation Insights

Property Insurance Market Insurance Type Outlook

- Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Flood Insurance

- Earthquake Insurance

Property Insurance Market Coverage Type Outlook

- Actual Cash Value

- Replacement Cost

- Extended Replacement Cost

- Guaranteed Replacement Cost

Property Insurance Market End Use Outlook

- Residential

- Commercial

- Industrial

Property Insurance Market Distribution Channel Outlook

- Direct Sales

- Brokerage

- Online Platforms

- Banks

FAQs

What is the expected market size of the Spain Property Insurance Market in 2024?

The Spain Property Insurance Market is expected to be valued at 23.6 USD Billion in 2024.

What is the projected market size of the Spain Property Insurance Market by 2035?

By 2035, the market is projected to reach a value of 30.0 USD Billion.

What is the expected CAGR for the Spain Property Insurance Market from 2025 to 2035?

The expected compound annual growth rate (CAGR) for the market is 2.205 percent during the period from 2025 to 2035.

Which type of property insurance is expected to have the largest market share in 2024?

Homeowners Insurance is expected to dominate the market with a value of 10.5 USD Billion in 2024.

How much is the Renters Insurance market segment valued at in 2024?

In 2024, the Renters Insurance segment is valued at 5.0 USD Billion.

What is the expected market value for Flood Insurance by 2035?

Flood Insurance is projected to be valued at 3.9 USD Billion by 2035.

Who are the key players in the Spain Property Insurance Market?

Major players in the market include Zurich, Generali, Mapfre, and Axa among others.

What is the projected market value of Earthquake Insurance in 2024?

Earthquake Insurance is expected to be valued at 2.0 USD Billion in 2024.

What are the market growth opportunities in the Spain Property Insurance Market?

The market is expected to benefit from increasing property ownership and demand for comprehensive coverage.

How much is the Condo Insurance segment expected to grow by 2035?

The Condo Insurance segment is expected to grow to 3.8 USD Billion by 2035.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”