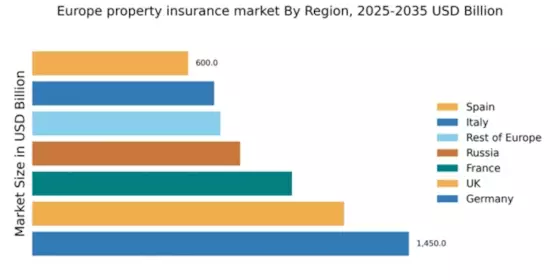

Germany : Strong Growth and Demand Trends

Germany holds a dominant position in the European property insurance market, accounting for approximately 30% of the total market share with a value of $1450.0 million. Key growth drivers include a robust economy, increasing urbanization, and a rising awareness of property protection. Regulatory policies, such as the Insurance Contract Act, promote transparency and consumer rights, while significant investments in infrastructure bolster demand for insurance products.

UK : Evolving Consumer Preferences Drive Growth

The UK property insurance market is valued at $1200.0 million, representing about 25% of the European market. Growth is fueled by evolving consumer preferences, particularly towards digital solutions and personalized insurance products. Regulatory frameworks, including the Financial Conduct Authority's guidelines, ensure fair practices, while the increasing frequency of natural disasters drives demand for comprehensive coverage.

France : Regulatory Support and Innovation

France's property insurance market is valued at $1000.0 million, capturing around 20% of the European market. Key growth drivers include a strong regulatory framework that encourages innovation and consumer protection. The demand for property insurance is rising, particularly in urban areas like Paris, where property values are high. Government initiatives aimed at promoting sustainable housing also contribute to market growth.

Russia : Increasing Demand Amid Challenges

Russia's property insurance market is valued at $800.0 million, accounting for about 15% of the European market. Growth is driven by increasing urbanization and a growing middle class seeking property protection. However, challenges such as regulatory complexities and economic fluctuations impact market dynamics. Key cities like Moscow and St. Petersburg are central to market development, with local players like SOGAZ gaining prominence.

Italy : Cultural Factors Influence Insurance Choices

Italy's property insurance market is valued at $700.0 million, representing approximately 12% of the European market. Growth is supported by cultural factors that emphasize property ownership and protection. Regulatory policies encourage competition, while local players like Generali dominate the landscape. Key markets include major cities such as Rome and Milan, where demand for insurance products is robust due to high property values.

Spain : Recovery Fuels Insurance Demand

Spain's property insurance market is valued at $600.0 million, making up about 10% of the European market. The market is experiencing a revitalization post-economic crisis, with increasing demand for property insurance driven by rising property values and a recovering economy. Regulatory support and initiatives to promote home ownership further enhance market prospects, particularly in cities like Madrid and Barcelona.

Rest of Europe : Regional Differences Shape Insurance Trends

The Rest of Europe property insurance market is valued at $724.07 million, accounting for about 8% of the total market. This sub-region encompasses a variety of markets with distinct characteristics, influenced by local regulations and economic conditions. Countries like Belgium and the Netherlands show strong demand for innovative insurance products, while others face challenges. The competitive landscape includes both local and international players, adapting to diverse consumer needs.