Focus on Patient-Centric Services

The increasing emphasis on patient-centric services is reshaping the Spain pharmacy management system market. Pharmacies are now prioritizing personalized care, which necessitates the implementation of management systems that can support tailored services. Data indicates that over 70 percent of patients prefer pharmacies that offer personalized health consultations and medication management. This trend is prompting pharmacies to invest in systems that enhance patient interaction and satisfaction. As a result, the Spain pharmacy management system market is likely to expand, driven by the need for solutions that align with the evolving expectations of healthcare consumers.

Regulatory Changes and Compliance

Regulatory changes in Spain are significantly influencing the pharmacy management system market. The government has implemented stringent regulations aimed at ensuring the safety and efficacy of pharmaceutical products. Compliance with these regulations necessitates the adoption of sophisticated management systems that can track and report data accurately. For instance, the introduction of the Falsified Medicines Directive has compelled pharmacies to enhance their verification processes. Consequently, the Spain pharmacy management system market is experiencing a surge in demand for solutions that facilitate compliance, thereby driving innovation and investment in this sector.

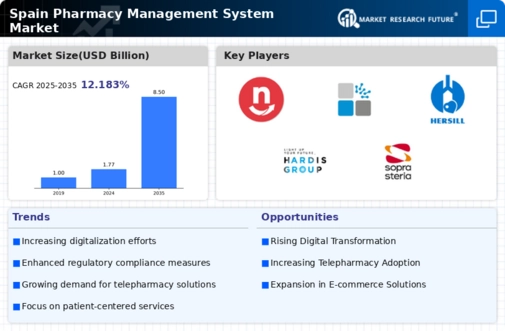

Digital Transformation in Pharmacies

The ongoing digital transformation within the Spain pharmacy management system market appears to be a pivotal driver. Pharmacies are increasingly adopting advanced technologies such as cloud-based solutions and mobile applications to enhance operational efficiency. According to recent data, approximately 60 percent of pharmacies in Spain have integrated some form of digital management system. This shift not only streamlines inventory management but also improves patient engagement through personalized services. As pharmacies embrace these technologies, the Spain pharmacy management system market is likely to witness substantial growth, driven by the demand for innovative solutions that cater to both operational needs and customer expectations.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into pharmacy management systems is emerging as a transformative driver in the Spain pharmacy management system market. AI technologies are being utilized to optimize inventory management, predict medication demand, and enhance customer service through chatbots and virtual assistants. Recent studies suggest that AI can reduce operational costs by up to 30 percent, making it an attractive option for pharmacies. As AI adoption increases, the Spain pharmacy management system market is expected to evolve, offering more sophisticated tools that improve efficiency and customer engagement.

Rising Demand for Telepharmacy Solutions

The rising demand for telepharmacy solutions is significantly impacting the Spain pharmacy management system market. With the growing acceptance of remote healthcare services, pharmacies are increasingly offering telepharmacy options to meet patient needs. This trend is supported by data indicating that nearly 40 percent of patients are open to receiving pharmaceutical consultations online. As pharmacies adapt to this shift, they require management systems that can seamlessly integrate telehealth services. Consequently, the Spain pharmacy management system market is poised for growth, driven by the need for innovative solutions that facilitate remote patient care.