Personalized Patient Care Solutions

The demand for personalized patient care solutions is significantly influencing the Germany pharmacy management system market. As healthcare becomes increasingly patient-centric, pharmacies are seeking management systems that facilitate tailored medication management and adherence programs. By January 2026, it is estimated that over 50% of pharmacies in Germany will implement systems that allow for personalized medication plans based on individual patient needs and preferences. This trend is driven by the recognition that personalized care can lead to better health outcomes and increased patient satisfaction. Furthermore, the integration of patient data analytics into pharmacy management systems enables pharmacists to provide customized advice and support, enhancing the overall patient experience. Consequently, the focus on personalized patient care is a vital driver in the Germany pharmacy management system market, promoting the development of innovative solutions that cater to diverse patient populations.

Integration of E-Prescribing Systems

The integration of e-prescribing systems is emerging as a significant driver in the Germany pharmacy management system market. E-prescribing enhances the efficiency of prescription management by allowing healthcare providers to send prescriptions electronically to pharmacies. As of January 2026, it is projected that nearly 70% of prescriptions in Germany will be transmitted electronically, streamlining the dispensing process and reducing the likelihood of errors. This shift not only improves patient safety but also facilitates better communication between prescribers and pharmacists. The adoption of e-prescribing systems is further supported by government initiatives aimed at digitizing healthcare services, which encourage pharmacies to upgrade their management systems. Therefore, the integration of e-prescribing is likely to play a crucial role in the evolution of the Germany pharmacy management system market, driving efficiency and enhancing patient care.

Regulatory Compliance and Data Security

Regulatory compliance remains a critical driver in the Germany pharmacy management system market. The stringent regulations imposed by the Federal Institute for Drugs and Medical Devices (BfArM) necessitate that pharmacies implement systems that ensure data security and patient confidentiality. As of January 2026, compliance with the General Data Protection Regulation (GDPR) is paramount, compelling pharmacies to adopt management systems that safeguard sensitive patient information. The potential for hefty fines and legal repercussions for non-compliance further incentivizes pharmacies to invest in secure management solutions. Moreover, the increasing prevalence of cyber threats in the healthcare sector amplifies the need for robust data protection measures. Thus, the focus on regulatory compliance and data security is driving the adoption of advanced pharmacy management systems in Germany, ensuring that pharmacies can operate within legal frameworks while protecting patient data.

Digital Transformation in Pharmacy Operations

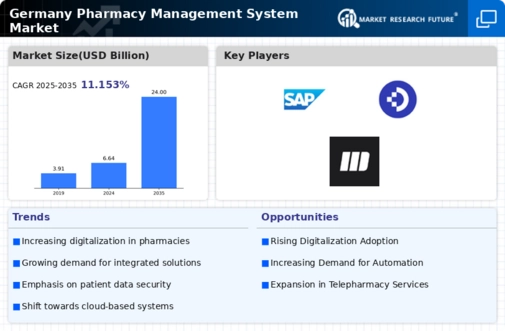

The ongoing digital transformation within the Germany pharmacy management system market is reshaping how pharmacies operate. The integration of advanced technologies such as cloud computing, artificial intelligence, and data analytics is enhancing operational efficiency and patient care. As of January 2026, approximately 60% of pharmacies in Germany have adopted some form of digital management system, indicating a strong trend towards modernization. This shift not only streamlines inventory management and prescription processing but also improves communication between healthcare providers and patients. The increasing demand for telepharmacy services further underscores the necessity for robust pharmacy management systems that can support remote consultations and medication delivery. Consequently, the digital transformation is a pivotal driver in the Germany pharmacy management system market, fostering innovation and improving overall healthcare delivery.

Growing Demand for Inventory Management Solutions

The growing demand for effective inventory management solutions is a key driver in the Germany pharmacy management system market. As pharmacies face challenges related to stock management, including overstocking and stockouts, the need for sophisticated inventory control systems has become increasingly apparent. By January 2026, it is estimated that around 65% of pharmacies in Germany will utilize advanced inventory management features within their pharmacy management systems. These solutions enable real-time tracking of stock levels, automated reordering processes, and improved forecasting capabilities. The ability to manage inventory efficiently not only reduces operational costs but also ensures that patients have access to necessary medications without delay. Consequently, the emphasis on inventory management solutions is shaping the landscape of the Germany pharmacy management system market, driving innovation and operational excellence.