Regulatory Compliance

Regulatory compliance remains a pivotal driver in the GCC pharmacy management system market. Governments across the GCC are implementing stringent regulations to ensure the safety and efficacy of pharmaceutical products. This has led to an increased demand for pharmacy management systems that can facilitate compliance with local and international standards. For example, the Saudi Food and Drug Authority (SFDA) has established guidelines that pharmacies must adhere to, prompting the need for robust management systems that can track and report compliance metrics. The GCC pharmacy management system market is likely to see a rise in system implementations that prioritize regulatory adherence, thereby enhancing the overall quality of pharmaceutical services.

Technological Advancements

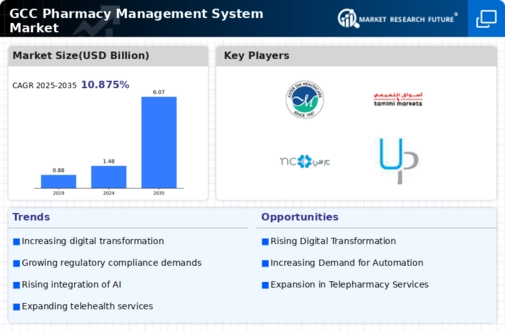

The GCC pharmacy management system market is experiencing a surge in technological advancements, which are reshaping the landscape of pharmacy operations. Innovations such as artificial intelligence, machine learning, and cloud computing are being integrated into pharmacy management systems, enhancing efficiency and accuracy. For instance, the adoption of AI-driven analytics allows pharmacies to optimize inventory management and streamline workflows. According to recent data, the GCC region is projected to witness a growth rate of approximately 12% in the adoption of advanced pharmacy management technologies over the next five years. This trend indicates a strong inclination towards leveraging technology to improve patient care and operational efficiency within the GCC pharmacy management system market.

Rising Demand for Automation

The GCC pharmacy management system market is witnessing a rising demand for automation in pharmacy operations. As pharmacies strive to enhance operational efficiency and reduce human error, automated systems are becoming increasingly essential. Automation in prescription processing, inventory management, and billing can significantly reduce the time taken for these tasks, leading to improved customer satisfaction. Recent statistics indicate that pharmacies utilizing automated management systems report a 30% increase in operational efficiency. This trend is expected to continue, as more pharmacies in the GCC recognize the benefits of automation, thereby driving growth in the pharmacy management system market.

Focus on Patient-Centric Care

The emphasis on patient-centric care is a significant driver in the GCC pharmacy management system market. Pharmacies are increasingly adopting systems that prioritize patient engagement and personalized services. This shift is largely influenced by the growing awareness of the importance of patient satisfaction and outcomes. Pharmacy management systems that offer features such as medication therapy management and personalized health consultations are gaining traction. Data suggests that pharmacies implementing patient-centric solutions can enhance patient adherence to medication regimens, ultimately improving health outcomes. As a result, the GCC pharmacy management system market is likely to see a continued focus on developing solutions that cater to the needs of patients.

Integration of Telehealth Services

The integration of telehealth services is emerging as a crucial driver in the GCC pharmacy management system market. With the increasing acceptance of telemedicine, pharmacies are looking to incorporate telehealth functionalities into their management systems. This integration allows pharmacies to offer remote consultations, medication delivery, and follow-up services, thereby expanding their reach and improving patient access to care. Recent surveys indicate that over 60% of patients in the GCC are open to using telehealth services for their pharmaceutical needs. Consequently, the pharmacy management system market is likely to evolve, with a growing number of systems designed to support telehealth capabilities, enhancing the overall service delivery in the region.