Rise of E-commerce

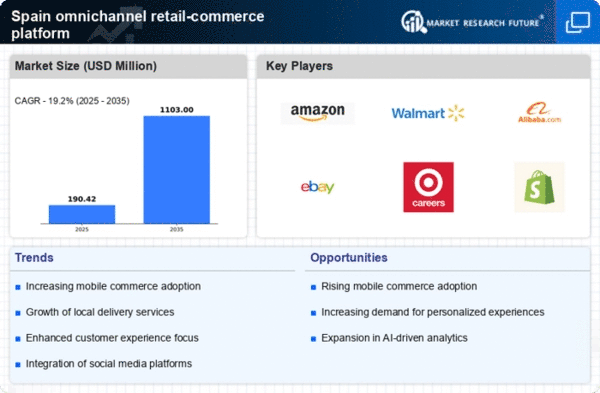

The rise of e-commerce is a driving force behind the growth of the omnichannel retail-commerce-platform market in Spain. With online sales accounting for approximately 15% of total retail sales, the demand for integrated shopping experiences is on the rise. Retailers are increasingly investing in their online platforms to meet this demand, leading to a projected growth rate of 20% in the e-commerce sector over the next few years. This growth is compelling traditional retailers to adopt omnichannel strategies that blend physical and digital shopping experiences. As e-commerce continues to expand, the omnichannel retail-commerce-platform market is poised for significant growth, driven by the need for retailers to adapt to changing consumer behaviors.

Competitive Landscape

The competitive landscape within the omnichannel retail-commerce-platform market in Spain is intensifying. Retailers are increasingly recognizing the need to differentiate themselves through unique value propositions. This competition is driving innovation, as companies strive to offer superior customer experiences. A recent survey indicated that 70% of retailers are prioritizing omnichannel strategies to remain competitive. This focus on differentiation is likely to lead to increased investments in marketing and technology, further propelling the growth of the omnichannel retail-commerce-platform market. As businesses seek to capture market share, the emphasis on unique offerings and customer-centric approaches will shape the future of retail in Spain.

Regulatory Environment

The regulatory environment in Spain is influencing the omnichannel retail-commerce-platform market. Recent regulations aimed at enhancing consumer protection and data privacy are prompting retailers to adapt their practices. Compliance with these regulations may require significant investment in technology and training, which could impact operational costs. However, these regulations also present an opportunity for retailers to build trust with consumers, potentially leading to increased loyalty. As businesses navigate this evolving regulatory landscape, the omnichannel retail-commerce-platform market is likely to see a shift towards more transparent and responsible practices, which could enhance overall market growth.

Technological Advancements

Technological advancements play a crucial role in shaping the omnichannel retail-commerce-platform market in Spain. The integration of artificial intelligence (AI) and machine learning is transforming how retailers interact with customers. For instance, AI-driven analytics can enhance inventory management and optimize supply chains, leading to a projected 25% increase in operational efficiency. Furthermore, the rise of mobile commerce is compelling retailers to develop mobile-friendly platforms that facilitate easy access to products and services. As technology continues to evolve, it is likely that the omnichannel retail-commerce-platform market will see increased investment in innovative solutions that enhance customer engagement and streamline operations.

Evolving Consumer Preferences

The omnichannel retail-commerce-platform market in Spain is experiencing a notable shift in consumer preferences. Shoppers increasingly favor seamless experiences that integrate online and offline channels. This trend is evidenced by a 30% rise in consumers who prefer to research products online before making in-store purchases. Retailers are adapting by enhancing their platforms to provide comprehensive product information and personalized recommendations. This evolution in consumer behavior necessitates that businesses invest in technology that supports these preferences, thereby driving growth in the omnichannel retail-commerce-platform market. As consumers demand more flexibility and convenience, retailers must respond by creating cohesive shopping experiences that cater to these evolving expectations.