Rising E-commerce Adoption

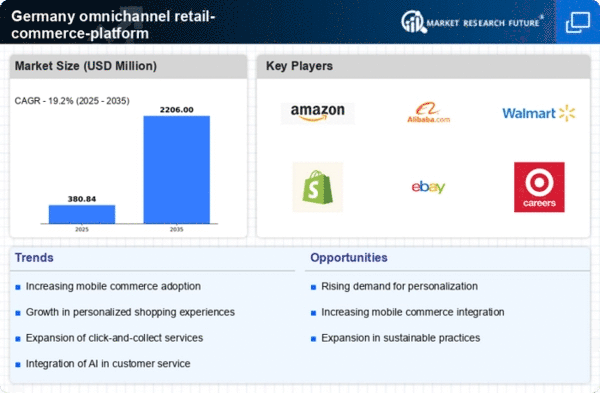

The omnichannel retail-commerce-platform market in Germany is experiencing a notable surge in e-commerce adoption. As of 2025, approximately 80% of consumers engage in online shopping, reflecting a shift in purchasing behavior. This trend is driven by the convenience of online platforms, which allow consumers to shop anytime and anywhere. Retailers are increasingly investing in their digital infrastructure to meet this demand, leading to a more integrated shopping experience. The omnichannel retail-commerce-platform market benefits from this growing preference for online shopping, as businesses strive to create seamless transitions between physical and digital channels. This shift not only enhances customer engagement but also drives sales growth, with e-commerce sales projected to reach €100 billion in Germany by 2026. Consequently, the market is likely to see continued investment in technology and logistics to support this evolving landscape.

Expansion of Mobile Commerce

The omnichannel retail-commerce-platform market is witnessing a significant expansion in mobile commerce, driven by the increasing use of smartphones among consumers in Germany. As of November 2025, mobile devices account for over 50% of all e-commerce transactions, indicating a shift towards mobile-first shopping experiences. Retailers are adapting their strategies to optimize mobile platforms, ensuring that their websites and applications are user-friendly and efficient. This trend is likely to continue, as mobile commerce is projected to grow by 25% annually in the coming years. The omnichannel retail-commerce-platform market must therefore prioritize mobile optimization to capture this growing segment of consumers who prefer shopping via their smartphones. This shift not only enhances accessibility but also encourages impulse buying, further driving sales in the market.

Integration of Social Commerce

The integration of social commerce is emerging as a pivotal driver in the omnichannel retail-commerce-platform market. In Germany, social media platforms are increasingly being utilized as shopping channels, with approximately 40% of consumers reporting that they have made purchases directly through social media. This trend is reshaping the way retailers engage with customers, as they leverage social media for marketing and sales. The omnichannel retail-commerce-platform market is adapting to this shift by incorporating social commerce strategies, which may lead to increased brand visibility and customer interaction. As social commerce continues to grow, it is expected that retailers who effectively harness these platforms could see a boost in sales, potentially increasing their revenue by 20% within the next few years. This evolution highlights the importance of integrating social media into the overall retail strategy.

Focus on Supply Chain Efficiency

Efficiency in supply chain management is becoming increasingly critical for the omnichannel retail-commerce-platform market. In Germany, retailers are recognizing the need for streamlined operations to meet the demands of an omnichannel approach. As of 2025, approximately 60% of retailers are investing in technologies that enhance supply chain visibility and responsiveness. This focus on efficiency is essential for reducing costs and improving customer satisfaction, as timely delivery and inventory management are paramount in an omnichannel environment. The omnichannel retail-commerce-platform market is thus likely to see advancements in logistics and supply chain technologies, which could lead to a reduction in operational costs by up to 15%. This emphasis on supply chain efficiency not only supports better service delivery but also strengthens the competitive position of retailers in the market.

Consumer Demand for Personalization

In the omnichannel retail-commerce-platform market, there is a marked increase in consumer demand for personalized shopping experiences. German consumers are increasingly expecting tailored recommendations and customized interactions based on their preferences and shopping history. This demand for personalization is prompting retailers to leverage data analytics and artificial intelligence to enhance customer engagement. As of 2025, around 70% of consumers express a preference for brands that offer personalized experiences. Retailers that successfully implement these strategies are likely to see improved customer loyalty and higher conversion rates. The omnichannel retail-commerce-platform market is thus evolving to incorporate advanced technologies that facilitate personalized marketing, which could lead to a potential increase in sales by up to 30% for businesses that effectively utilize these tools.