Growing Awareness and Education

There is a notable increase in awareness and education regarding neurological health in Spain, which serves as a catalyst for the neurology devices market. Public health campaigns and educational programs are being implemented to inform the population about neurological disorders and the importance of early diagnosis and treatment. This heightened awareness is leading to more individuals seeking medical attention, thereby increasing the demand for neurology devices. Furthermore, healthcare professionals are being trained to utilize these devices effectively, which enhances their adoption in clinical settings. As a result, the market is expected to experience growth as more patients are diagnosed and treated with advanced technologies.

Supportive Regulatory Environment

The regulatory environment in Spain is becoming increasingly supportive of the neurology devices market. The Spanish Agency of Medicines and Medical Devices (AEMPS) has streamlined the approval process for new medical technologies, facilitating quicker access to innovative neurology devices. This supportive framework encourages manufacturers to invest in research and development, leading to the introduction of novel products in the market. Additionally, the alignment of Spanish regulations with European Union standards enhances market confidence and fosters competition. As a result, the neurology devices market is poised for growth, with a diverse range of products becoming available to healthcare providers and patients.

Investment in Healthcare Infrastructure

Spain's commitment to enhancing its healthcare infrastructure significantly impacts the neurology devices market. The government has allocated substantial funding to modernize hospitals and clinics, which includes the procurement of advanced medical technologies. Reports indicate that healthcare spending in Spain is expected to reach €200 billion by 2026, with a notable portion directed towards neurology. This investment not only facilitates the acquisition of cutting-edge neurology devices but also promotes research and development initiatives. As healthcare facilities upgrade their capabilities, the demand for innovative neurology devices is likely to rise, fostering a more robust market environment.

Rising Incidence of Neurological Disorders

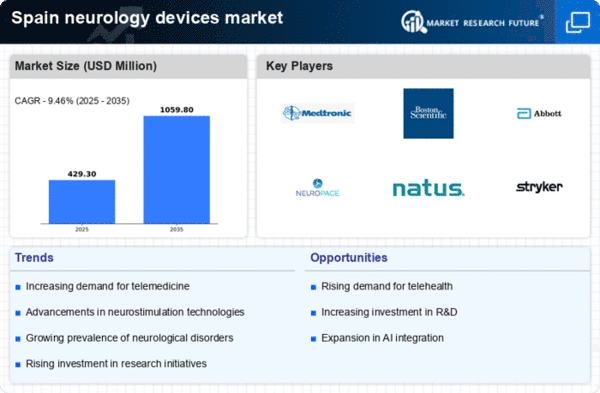

The increasing prevalence of neurological disorders in Spain is a primary driver for the neurology devices market. Conditions such as Alzheimer's disease, Parkinson's disease, and multiple sclerosis are becoming more common, with estimates suggesting that around 1.2 million individuals are affected by these disorders in the country. This rising incidence necessitates the development and adoption of advanced neurology devices for diagnosis and treatment. The market is projected to grow at a CAGR of approximately 8.5% over the next five years, driven by the demand for innovative solutions that enhance patient care and improve outcomes. As healthcare providers seek to address this growing burden, investments in neurology devices are likely to increase, further propelling market expansion.

Technological Innovations in Device Design

The neurology devices market is witnessing a surge in technological innovations that enhance device design and functionality. Advances in areas such as neuroimaging, neurostimulation, and wearable technologies are transforming the landscape of neurological care in Spain. For instance, the introduction of portable EEG devices and advanced neuroimaging systems is improving diagnostic accuracy and patient monitoring. These innovations not only provide better outcomes for patients but also attract investment from both public and private sectors. As technology continues to evolve, the neurology devices market is likely to expand, driven by the demand for more efficient and effective treatment options.