Growing Aging Population

The shift towards an aging population in Spain is a significant driver for the occlusion devices market. As individuals age, the likelihood of developing conditions that require occlusion devices, such as aneurysms and vascular diseases, increases. This demographic trend is prompting healthcare systems to adapt and expand their offerings in interventional procedures. The Spanish government is also recognizing the need for enhanced healthcare services for the elderly, leading to increased funding and support for medical technologies. Consequently, the occlusion devices market is expected to benefit from this growing demand, with estimates suggesting that the elderly population will constitute over 25% of the total population by 2030. This shift indicates a sustained need for effective medical solutions, thereby driving growth in the occlusion devices market.

Rising Healthcare Expenditure

The increase in healthcare expenditure in Spain positively impacts the occlusion devices market. With the government and private sectors investing more in healthcare infrastructure, there is a greater emphasis on acquiring advanced medical technologies. This trend is evident in the allocation of funds towards innovative medical devices, including occlusion devices, which are essential for various surgical procedures. The Spanish healthcare system is evolving, with a focus on improving patient care and outcomes, which in turn drives the demand for high-quality occlusion devices. Reports indicate that healthcare spending in Spain is projected to reach approximately €200 billion by 2026, reflecting a commitment to enhancing medical services. This financial support is likely to foster growth in the occlusion devices market, as healthcare providers seek to implement the latest technologies.

Increased Awareness and Education

Growing awareness and education about cardiovascular health and related conditions influence the occlusion devices market in Spain. Public health campaigns and educational initiatives are informing both healthcare professionals and patients about the importance of early detection and treatment of vascular diseases. This heightened awareness is leading to an increase in diagnostic procedures and subsequent interventions that utilize occlusion devices. Furthermore, medical institutions are prioritizing training programs for healthcare providers, ensuring they are well-equipped to utilize these devices effectively. As a result, the market is likely to see a rise in demand for occlusion devices, as more patients seek treatment options. The emphasis on education and awareness is expected to contribute to a more informed patient population, ultimately driving growth in the occlusion devices market.

Technological Innovations in Medical Devices

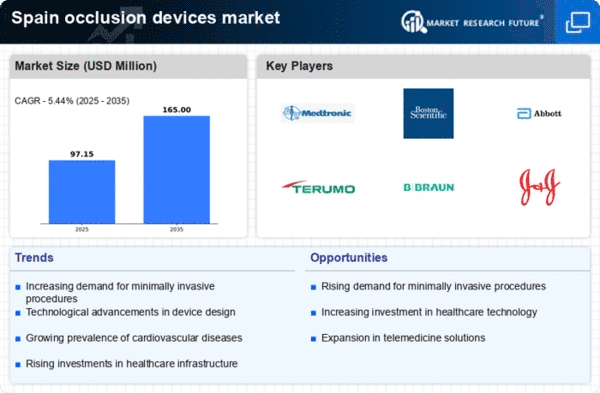

Technological advancements in medical devices are significantly influencing the occlusion devices market in Spain. Innovations such as improved imaging techniques and the development of biocompatible materials are enhancing the efficacy and safety of occlusion devices. These advancements not only improve patient outcomes but also increase the adoption rates among healthcare professionals. The integration of digital technologies, such as artificial intelligence and machine learning, is further streamlining the design and manufacturing processes of these devices. As a result, the market is witnessing a surge in new product launches, with several companies investing heavily in research and development. This focus on innovation is expected to propel the occlusion devices market forward, with projections indicating a market value exceeding €500 million by 2027.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases in Spain is a critical driver for the occlusion devices market. According to health statistics, cardiovascular diseases account for a significant portion of mortality rates, prompting healthcare providers to seek effective treatment options. This trend is likely to increase the demand for occlusion devices, which are essential in various interventional procedures. The Spanish healthcare system is adapting to this growing need by investing in advanced medical technologies, thereby enhancing the availability of occlusion devices. As a result, the market is projected to experience substantial growth, with estimates suggesting a compound annual growth rate (CAGR) of around 8% over the next few years. This increasing prevalence underscores the necessity for innovative solutions in the occlusion devices market, driving both research and development efforts in the sector.