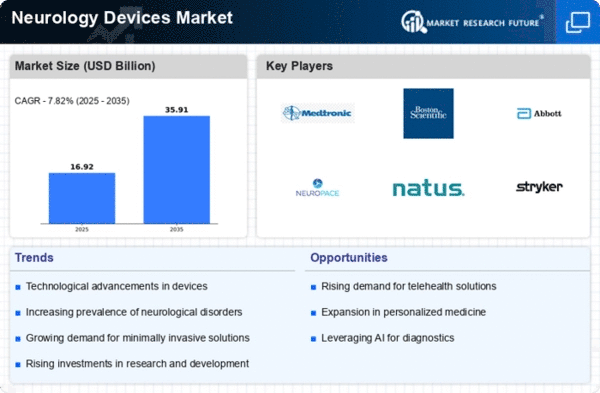

Market Growth Projections

The Global Neurology Devices Market Industry is poised for substantial growth, with projections indicating a market size of 15.7 USD Billion in 2024 and an anticipated increase to 35.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 7.82% from 2025 to 2035. The expansion is driven by various factors, including technological advancements, increasing prevalence of neurological disorders, and supportive government initiatives. As the market evolves, it is expected to attract significant investments, fostering innovation and enhancing the availability of neurology devices worldwide.

Growing Geriatric Population

The expanding geriatric population is a significant factor influencing the Global Neurology Devices Market Industry. As individuals age, the risk of developing neurological disorders increases, necessitating the use of various neurology devices for diagnosis and treatment. According to projections, the global population aged 65 and older is expected to reach 1.5 billion by 2050. This demographic shift is likely to result in a surge in demand for neurology devices, as older adults are more susceptible to conditions such as stroke and dementia. Consequently, the market is poised for substantial growth, aligning with the anticipated increase in device utilization.

Rising Awareness and Education

Increasing awareness and education regarding neurological disorders and available treatment options are contributing to the growth of the Global Neurology Devices Market Industry. Campaigns aimed at educating the public and healthcare professionals about the symptoms and management of neurological conditions are becoming more prevalent. This heightened awareness leads to earlier diagnosis and treatment, thereby increasing the demand for neurology devices. Moreover, educational programs and resources provided by health organizations are empowering patients to seek medical assistance, further driving market growth as more individuals are diagnosed and treated with advanced devices.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure and funding for neurological research are pivotal in driving the Global Neurology Devices Market Industry. Various countries are increasing their investments in healthcare, particularly in neurology, to address the growing burden of neurological diseases. For example, the National Institutes of Health in the United States has allocated substantial funding for neurological research, which encourages innovation and development in neurology devices. Such initiatives not only enhance the market landscape but also stimulate collaboration between public and private sectors, fostering advancements in device technology.

Increasing Prevalence of Neurological Disorders

The rising incidence of neurological disorders, such as Alzheimer's disease, Parkinson's disease, and epilepsy, is a primary driver of the Global Neurology Devices Market Industry. As populations age, the prevalence of these conditions is expected to escalate, leading to a greater demand for diagnostic and therapeutic devices. For instance, the World Health Organization indicates that the number of people with dementia is projected to reach 152 million by 2050. This growing patient population necessitates advanced neurology devices, contributing to the market's projected growth from 15.7 USD Billion in 2024 to 35.9 USD Billion by 2035.

Technological Advancements in Neurology Devices

Innovations in technology are transforming the Global Neurology Devices Market Industry, enhancing the efficacy and accessibility of treatment options. Developments in neurostimulation devices, imaging technologies, and minimally invasive surgical techniques are notable examples. For instance, advancements in MRI and CT imaging have improved diagnostic accuracy, while new neurostimulation devices offer better patient outcomes. These technological improvements not only increase the demand for existing devices but also pave the way for new product introductions, potentially driving the market's compound annual growth rate of 7.82% from 2025 to 2035.