Rising Incidence of Cancer

The increasing prevalence of cancer in Spain is a primary driver for the positron emission-tomography-devices market. According to recent statistics, cancer cases have surged, with estimates suggesting that nearly 1 in 2 individuals may be diagnosed with some form of cancer in their lifetime. This alarming trend necessitates advanced diagnostic tools, such as positron emission tomography (PET) devices, which are crucial for accurate staging and treatment planning. The demand for these devices is likely to grow as healthcare providers seek to enhance patient outcomes through early and precise diagnosis. Furthermore, the Spanish healthcare system is increasingly investing in advanced imaging technologies, which could further bolster the positron emission-tomography-devices market in the coming years.

Technological Innovations in Imaging

Technological innovations in imaging modalities are transforming the landscape of the positron emission-tomography-devices market. Advances in detector technology, image reconstruction algorithms, and hybrid imaging systems are enhancing the capabilities of PET devices. These innovations not only improve image quality but also reduce scan times, making PET scans more accessible to patients. In Spain, research institutions and medical technology companies are collaborating to develop cutting-edge PET solutions, which could lead to a surge in market growth. The introduction of new features, such as real-time imaging and integration with other diagnostic tools, may further drive the adoption of positron emission tomography devices in clinical settings.

Growing Awareness of Diagnostic Imaging

There is a notable increase in public awareness regarding the importance of diagnostic imaging in Spain, which serves as a catalyst for the positron emission-tomography-devices market. Educational campaigns and outreach programs have highlighted the role of advanced imaging techniques in early disease detection and management. As patients become more informed about their health options, the demand for PET scans is likely to rise. This shift in patient behavior is supported by data indicating that diagnostic imaging utilization has increased by over 20% in recent years. Consequently, healthcare providers are more inclined to invest in positron emission tomography devices to meet the growing expectations of patients seeking timely and accurate diagnoses.

Investment in Healthcare Infrastructure

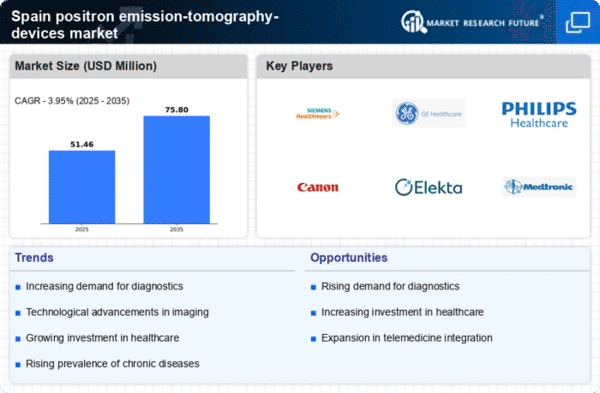

Spain's commitment to improving its healthcare infrastructure significantly impacts the positron emission-tomography-devices market. The government has allocated substantial funding to modernize hospitals and diagnostic centers, aiming to enhance the quality of care. This investment includes the procurement of advanced imaging technologies, such as PET devices, which are essential for comprehensive cancer care and other medical applications. Reports indicate that healthcare spending in Spain is projected to increase by approximately 5% annually, creating a favorable environment for the growth of the positron emission-tomography-devices market. As facilities upgrade their equipment, the demand for state-of-the-art PET devices is expected to rise, reflecting a broader trend towards technological advancement in healthcare.

Aging Population and Increased Healthcare Demand

The aging population in Spain is a significant driver of the positron emission-tomography-devices market. As the demographic shifts towards an older population, the incidence of age-related diseases, including cancer and neurological disorders, is expected to rise. This trend necessitates advanced diagnostic tools to manage these conditions effectively. Projections indicate that by 2030, nearly 25% of the Spanish population will be over 65 years old, leading to increased healthcare demands. Consequently, healthcare providers are likely to invest more in positron emission tomography devices to cater to the diagnostic needs of this growing demographic. The focus on improving healthcare services for the elderly could further stimulate market growth.