Aging Population

Spain's demographic shift towards an aging population is anticipated to significantly impact the mobile radiography-systems market. With a growing number of elderly individuals, the demand for diagnostic imaging services is likely to increase. The elderly population in Spain is projected to reach 9 million by 2030, which may lead to a higher incidence of chronic diseases requiring regular imaging. Mobile radiography systems offer the advantage of providing diagnostic services at the patient's location, thus catering to the needs of this demographic. This trend indicates a potential growth opportunity for manufacturers and service providers in the mobile radiography-systems market, as they adapt their offerings to meet the specific requirements of an aging population.

Rising Healthcare Expenditure

The mobile radiography-systems market in Spain is likely to benefit from the increasing healthcare expenditure observed in recent years. As the Spanish government allocates more funds towards healthcare, hospitals and clinics are expected to invest in advanced medical technologies, including mobile radiography systems. In 2023, healthcare spending in Spain reached approximately €200 billion, reflecting a growth of around 5% from the previous year. This trend suggests a favorable environment for the adoption of mobile radiography systems, as healthcare facilities seek to enhance diagnostic capabilities and improve patient outcomes. Furthermore, the emphasis on modernizing healthcare infrastructure may lead to a surge in demand for mobile solutions, thereby driving the market forward.

Increased Focus on Emergency Services

The mobile radiography-systems market is likely to experience growth. This is due to the heightened focus on emergency medical services in Spain. As healthcare providers aim to improve response times and patient care in emergency situations, mobile radiography systems become essential tools. The ability to perform imaging at the site of an emergency can significantly enhance patient management and treatment outcomes. In recent years, Spain has seen an increase in investment in emergency services, with funding rising by approximately 10% annually. This trend suggests that healthcare facilities will increasingly adopt mobile radiography systems to ensure timely and effective care, thus driving market expansion.

Technological Integration in Healthcare

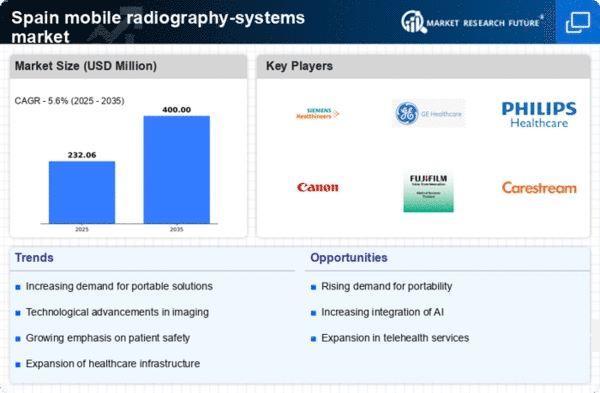

Advanced technologies are a driving force for the mobile radiography-systems market in Spain. Innovations such as artificial intelligence (AI) and machine learning are being increasingly incorporated into radiography systems, enhancing image quality and diagnostic accuracy. In 2025, it is estimated that the market for AI in medical imaging will reach €1 billion in Spain, indicating a strong trend towards technological adoption. This integration not only improves operational efficiency but also supports healthcare professionals in making informed decisions. As hospitals and clinics strive to stay competitive, the demand for technologically advanced mobile radiography systems is expected to rise, thereby propelling market growth.

Regulatory Support for Medical Innovations

Regulatory frameworks in Spain are becoming increasingly supportive of medical innovations, which is likely to benefit the mobile radiography-systems market. The Spanish Agency of Medicines and Medical Devices (AEMPS) has streamlined approval processes for new medical technologies, encouraging manufacturers to introduce advanced mobile radiography solutions. This regulatory support is crucial for fostering innovation and ensuring that healthcare providers have access to the latest technologies. As a result, the market is expected to see a rise in the availability of cutting-edge mobile radiography systems, which could enhance diagnostic capabilities and improve patient care across various healthcare settings.