Focus on Patient-Centric Care

The GCC Mobile Radiography Systems Market is increasingly aligning with the global shift towards patient-centric care. Healthcare providers in the region are prioritizing patient comfort and convenience, which is driving the adoption of mobile radiography systems. These systems enable imaging to be performed at the patient's bedside, reducing the need for transportation and minimizing discomfort. As a result, hospitals are investing in mobile solutions that enhance the patient experience. This focus on patient-centric care is likely to propel market growth, as facilities recognize the value of improving patient satisfaction and outcomes through innovative imaging solutions.

Government Initiatives and Funding

The GCC Mobile Radiography Systems Market benefits from various government initiatives aimed at enhancing healthcare infrastructure. Governments in the region are investing significantly in healthcare modernization, which includes the procurement of advanced mobile radiography systems. For example, initiatives in Saudi Arabia and the UAE are focused on improving healthcare accessibility and quality. This investment is expected to drive market growth, with funding allocated for the acquisition of mobile imaging technologies. The support from government bodies is likely to create a favorable environment for the expansion of the mobile radiography market in the GCC.

Rising Incidence of Chronic Diseases

The GCC Mobile Radiography Systems Market is influenced by the rising incidence of chronic diseases, which necessitates frequent imaging for diagnosis and monitoring. Conditions such as cardiovascular diseases and respiratory disorders are becoming increasingly prevalent in the region, leading to a higher demand for radiographic services. The market is projected to grow as healthcare providers seek efficient solutions to manage these conditions. The increasing burden of chronic diseases is likely to drive the adoption of mobile radiography systems, as they offer timely and accessible imaging options for patients requiring ongoing care.

Technological Advancements in Imaging

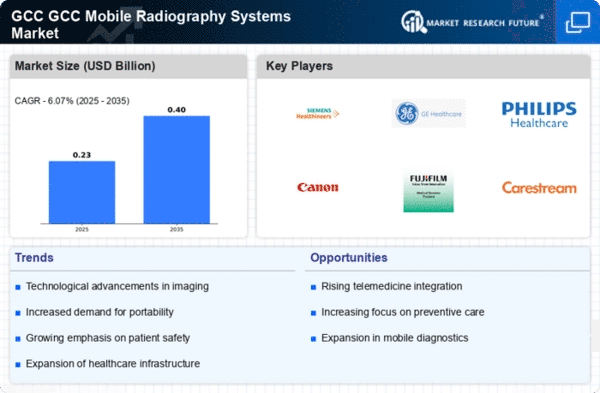

The GCC Mobile Radiography Systems Market is experiencing a surge in technological advancements, particularly in imaging capabilities. Innovations such as digital radiography and wireless technology are enhancing the quality and efficiency of mobile radiography systems. For instance, the integration of artificial intelligence in image processing is streamlining diagnostics, allowing for quicker and more accurate results. The GCC region has seen a notable increase in the adoption of these advanced systems, with a projected growth rate of approximately 8% annually. This trend indicates a strong market potential as healthcare facilities seek to upgrade their imaging technologies to improve patient outcomes and operational efficiency.

Increased Demand for Portable Solutions

The GCC Mobile Radiography Systems Market is witnessing a growing demand for portable radiography solutions. This demand is driven by the need for flexibility in healthcare settings, particularly in emergency and remote locations. Hospitals and clinics are increasingly investing in mobile systems that can be easily transported, allowing for immediate imaging services. The market for portable radiography systems in the GCC is expected to reach USD 150 million by 2026, reflecting a compound annual growth rate of 7%. This trend underscores the importance of mobility in healthcare, as providers aim to deliver timely diagnostics in various environments.