Aging Population

Italy's demographic shift towards an aging population is significantly impacting the mobile radiography-systems market. With approximately 23% of the population aged 65 and older, the demand for diagnostic imaging services is on the rise. Older adults often require more frequent medical evaluations, leading to an increased need for mobile radiography systems that can provide timely and efficient imaging solutions. The convenience of mobile systems allows for imaging in various settings, including nursing homes and outpatient facilities, which is particularly beneficial for elderly patients with mobility challenges. This demographic trend suggests a sustained demand for mobile radiography systems, as healthcare providers adapt to the needs of an aging population.

Rising Healthcare Expenditure

The mobile radiography-systems market in Italy is experiencing growth due to the increasing healthcare expenditure by both public and private sectors. In recent years, Italy has allocated a significant portion of its budget to healthcare, with spending reaching approximately €200 billion in 2025. This investment is likely to enhance the availability of advanced medical technologies, including mobile radiography systems. As hospitals and clinics seek to improve patient care and operational efficiency, the demand for mobile radiography systems is expected to rise. Furthermore, the Italian government has been promoting initiatives to modernize healthcare facilities, which may further drive the adoption of mobile radiography systems. This trend indicates a robust market potential for manufacturers and suppliers in the mobile radiography-systems market.

Increased Focus on Patient-Centric Care

The shift towards patient-centric care in Italy is influencing the mobile radiography-systems market. Healthcare providers are increasingly prioritizing patient comfort and convenience, which mobile radiography systems can offer. These systems allow for imaging to be performed at the patient's location, reducing the need for transportation and minimizing discomfort. As hospitals and clinics adopt patient-centered approaches, the demand for mobile radiography systems is expected to rise. This trend aligns with the broader movement in healthcare to enhance patient experiences and outcomes. Consequently, manufacturers of mobile radiography systems may find new opportunities to cater to this evolving market demand.

Technological Integration in Healthcare

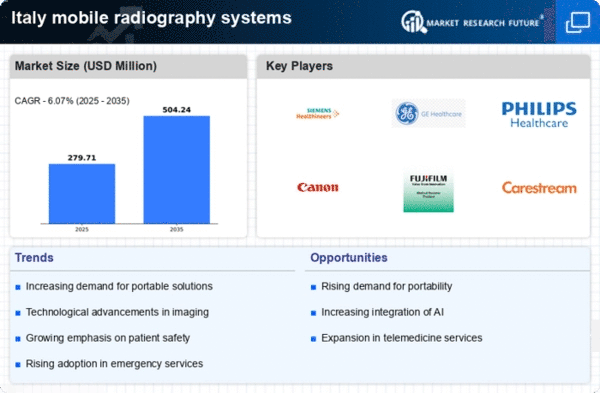

The integration of advanced technologies in healthcare is a key driver for the mobile radiography-systems market in Italy. Innovations such as artificial intelligence (AI) and cloud computing are being increasingly adopted in medical imaging. These technologies enhance the capabilities of mobile radiography systems, allowing for improved image quality and faster processing times. As healthcare facilities in Italy strive to provide high-quality care, the demand for technologically advanced mobile radiography systems is likely to grow. The market is projected to expand as hospitals and clinics invest in these systems to stay competitive and meet the evolving needs of patients. This trend indicates a promising future for the mobile radiography-systems market.

Regulatory Support for Medical Innovations

Regulatory frameworks in Italy are becoming more supportive of medical innovations, which is beneficial for the mobile radiography-systems market. The Italian Medicines Agency (AIFA) has been streamlining approval processes for new medical technologies, facilitating quicker access to advanced mobile radiography systems. This regulatory support encourages manufacturers to invest in research and development, leading to the introduction of innovative products in the market. As a result, healthcare providers are likely to adopt these new technologies to enhance diagnostic capabilities. The favorable regulatory environment suggests a positive outlook for the mobile radiography-systems market, as it fosters innovation and encourages the adoption of cutting-edge solutions.