Advancements in Genomic Research

The Spain microarray market is experiencing a surge due to advancements in genomic research. The integration of microarray technology in genomics has enabled researchers to analyze gene expression patterns with unprecedented accuracy. This has led to significant breakthroughs in understanding complex diseases, thereby driving demand for microarray products. In Spain, the National Institute of Health has reported a 20% increase in funding for genomic research initiatives, which directly benefits the microarray sector. Furthermore, collaborations between universities and biotech firms are fostering innovation, suggesting a robust growth trajectory for the Spain microarray market. As researchers continue to explore the genetic basis of diseases, the reliance on microarray technology is likely to expand, indicating a promising future for this segment.

Growing Focus on Cancer Research

Cancer research remains a pivotal driver for the Spain microarray market. With cancer being one of the leading causes of mortality in Spain, there is an urgent need for effective diagnostic and therapeutic tools. Microarrays facilitate the identification of cancer biomarkers, which are crucial for early detection and personalized treatment strategies. The Spanish government has allocated substantial resources to cancer research, with a reported increase of 15% in funding for oncology-related projects. This financial support is expected to enhance the capabilities of research institutions and biotech companies, thereby propelling the demand for microarray technologies. As the focus on cancer research intensifies, the Spain microarray market is poised for significant growth, driven by the need for innovative solutions in oncology.

Rising Demand for Diagnostic Tools

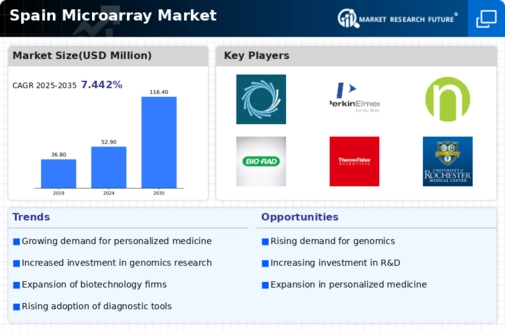

The demand for diagnostic tools is a significant driver of the Spain microarray market. As healthcare systems increasingly prioritize early diagnosis and personalized treatment, microarray technology is becoming essential for various applications, including genetic testing and disease profiling. The Spanish healthcare sector has reported a growing adoption of microarray-based diagnostics, with a projected market growth rate of 12% annually. This trend is supported by the increasing prevalence of genetic disorders and the need for tailored therapeutic approaches. Furthermore, the integration of microarray technology into routine clinical practice is likely to enhance patient outcomes, thereby reinforcing its importance in the Spain microarray market. As healthcare providers seek innovative solutions, the demand for microarray diagnostics is expected to continue its upward trajectory.

Increased Investment in Biotechnology

The Spain microarray market is benefiting from increased investment in biotechnology. The Spanish government, recognizing the potential of biotechnology to drive economic growth, has implemented policies to attract both domestic and foreign investments. In 2025, investments in the biotech sector reached approximately 1.5 billion euros, with a notable portion directed towards microarray technology development. This influx of capital is fostering innovation and enhancing the capabilities of local firms, enabling them to compete on a global scale. Additionally, the establishment of biotech clusters in regions such as Catalonia and Madrid is facilitating collaboration among stakeholders, further stimulating the Spain microarray market. As investment continues to rise, the potential for advancements in microarray applications appears promising.

Collaboration Between Academia and Industry

Collaboration between academia and industry is emerging as a crucial driver for the Spain microarray market. Universities and research institutions are increasingly partnering with biotech companies to translate scientific discoveries into practical applications. This synergy is fostering innovation in microarray technology, leading to the development of novel products and services. In Spain, several initiatives have been launched to promote such collaborations, resulting in a 30% increase in joint research projects over the past two years. These partnerships not only enhance the research capabilities of academic institutions but also provide industry players with access to cutting-edge research. As the collaboration between academia and industry strengthens, the Spain microarray market is likely to witness accelerated growth, driven by the continuous influx of innovative solutions.