Rising Focus on Cost Efficiency

Cost efficiency is becoming an essential consideration for laboratories in Spain, influencing their choice of laboratory information management systems. The Spain laboratory information management systems market is witnessing a shift towards solutions that not only enhance operational efficiency but also reduce overall costs. Laboratories are increasingly looking for LIMS that offer scalable solutions, allowing them to optimize resource allocation and minimize waste. This focus on cost efficiency is particularly relevant in the context of budget constraints faced by many public and private laboratories. As a result, vendors are responding by developing LIMS that provide flexible pricing models and customizable features, catering to the diverse needs of laboratories across Spain.

Emphasis on Regulatory Compliance

Regulatory compliance remains a critical driver in the Spain laboratory information management systems market. Laboratories are mandated to adhere to stringent regulations set forth by governmental bodies, which necessitates the implementation of robust information management systems. These systems not only streamline compliance processes but also ensure that data integrity is maintained throughout the laboratory workflow. The Spanish government has been proactive in establishing guidelines that govern laboratory operations, thereby increasing the demand for LIMS solutions that can effectively manage compliance-related data. As a result, laboratories are investing in LIMS to mitigate risks associated with non-compliance, which could lead to significant financial penalties.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is transforming the Spain laboratory information management systems market. These technologies enable laboratories to automate routine tasks, enhance data analysis capabilities, and improve overall operational efficiency. The adoption of AI-driven LIMS solutions is particularly noteworthy, as they facilitate predictive analytics and real-time data processing. This trend is expected to drive market growth, with estimates suggesting that the incorporation of advanced technologies could increase productivity in laboratories by up to 30%. Consequently, laboratories are increasingly seeking LIMS that incorporate these technologies to stay competitive in a rapidly evolving market.

Increased Collaboration and Data Sharing

The trend towards increased collaboration and data sharing among laboratories is significantly impacting the Spain laboratory information management systems market. As research becomes more interdisciplinary, laboratories are seeking LIMS that facilitate seamless data exchange and collaboration with external partners. This shift is driven by the recognition that collaborative efforts can lead to more innovative solutions and faster research outcomes. The Spanish government has also been promoting initiatives that encourage data sharing among research institutions, further fueling the demand for LIMS that support these collaborative efforts. Consequently, laboratories are investing in systems that enhance connectivity and interoperability, ensuring that they can effectively participate in collaborative research projects.

Growing Demand for Data Management Solutions

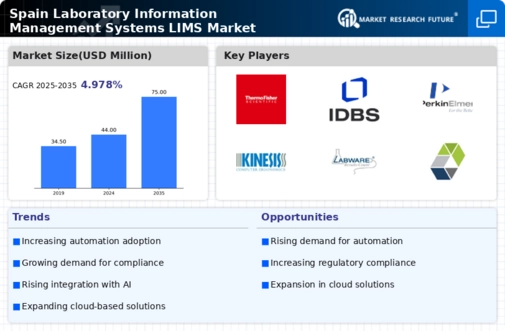

The Spain laboratory information management systems market is experiencing a notable surge in demand for efficient data management solutions. Laboratories are increasingly recognizing the necessity of managing vast amounts of data generated from various experiments and analyses. This trend is driven by the need for improved accuracy, traceability, and compliance with regulatory standards. According to recent statistics, the market for laboratory information management systems in Spain is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is indicative of laboratories' commitment to adopting advanced data management solutions that enhance operational efficiency and facilitate better decision-making processes.