Increased Focus on Data Security

Data security has emerged as a critical concern within the France laboratory information management systems market. With the rise of cyber threats and data breaches, laboratories are prioritizing the protection of sensitive information. The implementation of LIMS provides enhanced security features, including data encryption and access controls, which are essential for safeguarding laboratory data. In 2025, it was reported that over 40% of laboratories in France identified data security as a primary factor influencing their choice of LIMS. This heightened focus on data protection is likely to drive further investments in secure laboratory information management systems, underscoring the industry's commitment to maintaining data integrity.

Regulatory Compliance and Quality Assurance

Regulatory compliance remains a pivotal driver in the France laboratory information management systems market. Laboratories are mandated to adhere to various national and European regulations, which necessitate the implementation of robust data management systems. The French government has established stringent guidelines for laboratory practices, particularly in sectors such as pharmaceuticals and biotechnology. Consequently, laboratories are increasingly investing in LIMS to ensure compliance and maintain quality assurance. The integration of LIMS not only facilitates adherence to regulations but also enhances the overall quality of laboratory outputs, thereby fostering trust among stakeholders and clients.

Growing Demand for Efficient Data Management

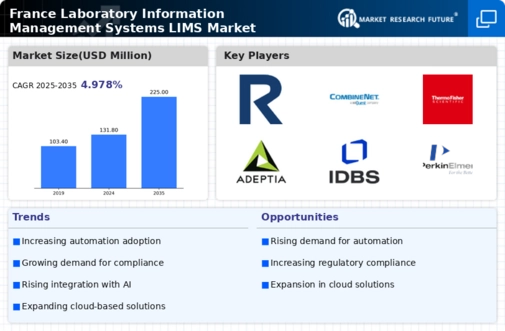

The France laboratory information management systems market is experiencing a notable surge in demand for efficient data management solutions. Laboratories are increasingly recognizing the necessity of streamlined data handling to enhance productivity and accuracy. This trend is driven by the need for compliance with stringent regulatory standards, which necessitate meticulous data tracking and reporting. In 2025, the market for laboratory information management systems in France was valued at approximately 200 million euros, reflecting a compound annual growth rate of around 8%. As laboratories strive to optimize their operations, the adoption of advanced LIMS solutions is likely to continue growing, indicating a robust future for the industry.

Rising Need for Integration with Other Systems

The need for seamless integration with other laboratory systems is becoming increasingly prominent in the France laboratory information management systems market. Laboratories often utilize various software solutions for different functions, such as inventory management and quality control. The ability to integrate LIMS with these systems is crucial for ensuring data consistency and operational efficiency. In 2025, approximately 25% of laboratories in France reported that integration capabilities were a key consideration when selecting a LIMS. As laboratories strive for holistic solutions that enhance workflow and reduce errors, the demand for integrative laboratory information management systems is expected to grow, indicating a dynamic shift in the industry.

Technological Advancements in Laboratory Operations

Technological advancements are significantly influencing the France laboratory information management systems market. The integration of cutting-edge technologies such as artificial intelligence and machine learning into LIMS is transforming laboratory operations. These innovations enable laboratories to automate routine tasks, analyze large datasets, and derive actionable insights with greater efficiency. In 2025, it is estimated that approximately 30% of laboratories in France have adopted AI-driven LIMS solutions, reflecting a growing trend towards modernization. As laboratories seek to enhance their operational capabilities, the demand for technologically advanced LIMS is expected to rise, indicating a promising trajectory for the industry.