Investment in Healthcare Infrastructure

The Spanish government has been actively investing in healthcare infrastructure, which serves as a catalyst for the electrophysiology market. Recent initiatives have focused on modernizing hospitals and expanding access to advanced medical technologies. This investment is crucial for improving the quality of care and ensuring that healthcare facilities are equipped to handle complex electrophysiological procedures. With an estimated budget increase of 8% for healthcare in the upcoming fiscal year, the market is poised for growth. Enhanced infrastructure not only facilitates better patient outcomes but also encourages the adoption of innovative electrophysiology solutions, thereby driving market expansion.

Aging Population and Associated Health Issues

Spain's aging population is a significant factor influencing the electrophysiology market. As the demographic shifts towards older age groups, the prevalence of cardiac disorders, such as atrial fibrillation, is expected to rise. Current estimates suggest that around 10% of the population over 65 years old is affected by such conditions. This demographic trend necessitates increased healthcare services and interventions, thereby driving demand for electrophysiological treatments. The healthcare system in Spain is adapting to these changes, which may lead to enhanced investment in electrophysiology technologies and services, ultimately fostering growth in the market.

Rising Awareness and Education on Cardiac Health

There is a growing awareness regarding cardiac health among the Spanish population, which is positively impacting the electrophysiology market. Educational campaigns and initiatives aimed at promoting heart health have led to increased public knowledge about the risks associated with cardiac disorders. This heightened awareness is likely to result in more individuals seeking medical advice and intervention for symptoms related to arrhythmias and other electrophysiological conditions. Consequently, healthcare providers are experiencing a surge in demand for electrophysiological assessments and treatments, which may lead to a robust growth trajectory for the market in the coming years.

Increasing Demand for Minimally Invasive Procedures

The growing preference for minimally invasive procedures is a notable driver in the electrophysiology market. Patients and healthcare providers in Spain are increasingly opting for techniques that reduce recovery time and minimize surgical risks. This trend is reflected in the rising number of catheter ablation procedures, which have seen an increase of approximately 15% annually. The shift towards these procedures is supported by advancements in technology, which enhance the efficacy and safety of electrophysiological interventions. As a result, the electrophysiology market is likely to experience substantial growth, driven by the demand for innovative solutions that align with patient preferences for less invasive treatment options.

Technological Innovations in Electrophysiology Devices

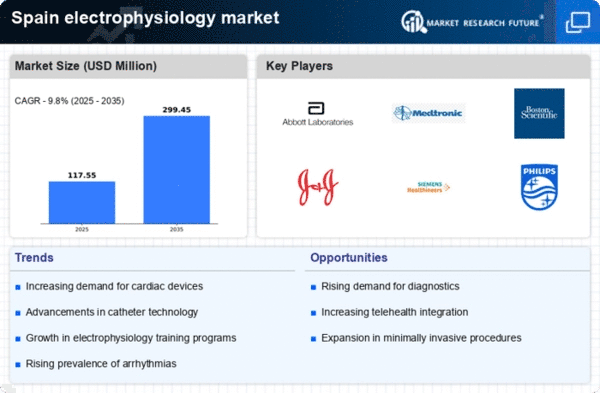

Technological innovations are playing a pivotal role in shaping the electrophysiology market. The introduction of advanced devices, such as 3D mapping systems and robotic-assisted catheter systems, is enhancing the precision and effectiveness of electrophysiological procedures. In Spain, the adoption of these technologies is expected to increase, driven by the need for improved patient outcomes and reduced procedural risks. Market data indicates that the segment for electrophysiology devices is projected to grow at a CAGR of 12% over the next five years. This trend suggests that ongoing research and development in the field will continue to propel the market forward, as healthcare providers seek to leverage cutting-edge technologies.