Aging Population and Associated Health Issues

The demographic shift towards an aging population in the US is significantly impacting the electrophysiology market. As individuals age, the prevalence of cardiac disorders, including atrial fibrillation and other arrhythmias, tends to increase. This demographic trend is expected to drive the demand for electrophysiology services and devices, as older adults often require specialized care for their heart conditions. According to recent statistics, approximately 20% of the US population will be over 65 years old by 2030, which could lead to a substantial increase in the number of patients requiring electrophysiological interventions. Consequently, healthcare providers are likely to invest more in electrophysiology technologies to cater to this growing patient base, thereby fostering market expansion.

Rising Demand for Minimally Invasive Procedures

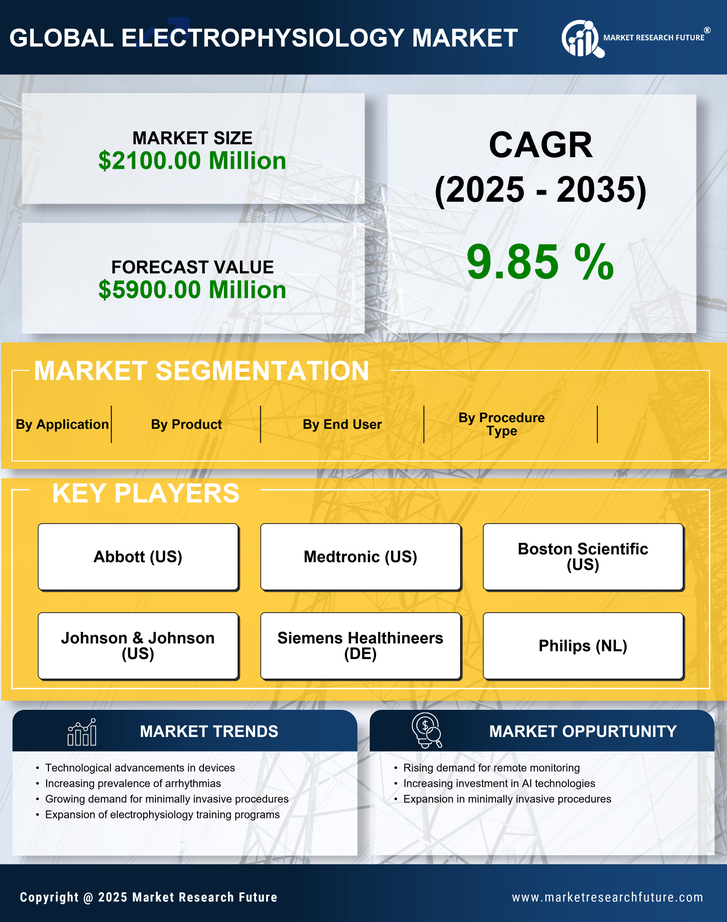

The electrophysiology market is experiencing a notable shift towards minimally invasive procedures, driven by patient preference for reduced recovery times and lower complication rates. As healthcare providers increasingly adopt these techniques, the demand for advanced electrophysiology devices is expected to rise. In the US, the market for minimally invasive cardiac procedures is projected to grow at a CAGR of approximately 8% over the next five years. This trend is likely to enhance the adoption of electrophysiology technologies, as they offer effective solutions for arrhythmias and other cardiac conditions. Furthermore, the increasing awareness among patients regarding the benefits of such procedures is anticipated to further propel the growth of the electrophysiology market, as more individuals seek out these innovative treatment options.

Growing Awareness and Education on Cardiac Health

There is a growing emphasis on education and awareness regarding cardiac health in the US, which is positively influencing the electrophysiology market. Public health campaigns and initiatives aimed at educating individuals about the risks of cardiac diseases are leading to increased screenings and early interventions. As awareness rises, more patients are likely to seek electrophysiological evaluations and treatments for their heart conditions. This trend is supported by the fact that early detection and management of arrhythmias can significantly improve patient outcomes. Consequently, healthcare providers are expected to enhance their electrophysiology services to meet the rising demand, potentially resulting in a market growth rate of approximately 6% over the next few years.

Increased Investment in Healthcare Infrastructure

The US government and private sector are significantly investing in healthcare infrastructure, which is likely to benefit the electrophysiology market. Enhanced funding for hospitals and clinics is facilitating the acquisition of advanced electrophysiology equipment and technologies. This investment is crucial for improving patient care and expanding access to electrophysiological services. Recent reports indicate that healthcare spending in the US is projected to reach $6 trillion by 2027, with a substantial portion allocated to cardiovascular care. As healthcare facilities upgrade their capabilities, the demand for sophisticated electrophysiology devices is expected to increase, thereby driving market growth and innovation in the field.

Technological Integration with Digital Health Solutions

The integration of digital health solutions into the electrophysiology market is emerging as a pivotal driver of growth. The incorporation of telemedicine, remote monitoring, and data analytics into electrophysiology practices is enhancing patient management and treatment outcomes. For instance, wearable devices that monitor heart rhythms can provide real-time data to healthcare providers, facilitating timely interventions. This trend is likely to increase the efficiency of electrophysiology services and improve patient engagement. As the US healthcare system continues to embrace digital transformation, the demand for electrophysiology devices that are compatible with these technologies is expected to rise, potentially leading to a market growth rate of around 7% annually over the next few years.