Aging Population and Associated Health Issues

The aging population in the UK is a critical driver for the electrophysiology market. As individuals age, the prevalence of cardiac disorders, such as atrial fibrillation, increases significantly. This demographic shift is expected to lead to a higher demand for electrophysiological interventions. According to recent statistics, approximately 1 in 4 adults over the age of 40 in the UK is likely to develop atrial fibrillation, which necessitates effective management strategies. Consequently, healthcare systems are investing in electrophysiology services to address this growing need. The increasing burden of age-related health issues is likely to stimulate the growth of the electrophysiology market as providers seek to implement more comprehensive care solutions.

Rising Awareness and Education on Cardiac Health

There is a notable increase in awareness and education regarding cardiac health among the UK population, which is positively impacting the electrophysiology market. Public health campaigns and educational initiatives have led to a greater understanding of the risks associated with cardiac disorders, prompting individuals to seek medical advice sooner. This heightened awareness is likely to result in earlier diagnoses and increased demand for electrophysiological assessments and treatments. Furthermore, healthcare providers are actively engaging in outreach programs to educate patients about the benefits of electrophysiological interventions. As a result, the electrophysiology market is expected to expand as more individuals pursue proactive measures for their cardiac health.

Government Initiatives and Funding for Cardiac Care

Government initiatives and funding aimed at improving cardiac care are playing a pivotal role in shaping the electrophysiology market. The UK government has recognized the need for enhanced cardiac services and has allocated substantial resources to support the development of advanced electrophysiology programs. This includes funding for research, training, and the acquisition of state-of-the-art equipment. Such initiatives are likely to facilitate the adoption of innovative electrophysiological techniques and improve patient access to care. As a result, the electrophysiology market is poised for growth, driven by these supportive government policies and investments in cardiac health infrastructure.

Increasing Demand for Minimally Invasive Procedures

The growing preference for minimally invasive procedures is a notable driver in the electrophysiology market. Patients and healthcare providers alike are increasingly opting for techniques that reduce recovery time and minimize surgical risks. This trend is reflected in the rising number of catheter ablation procedures, which have seen an increase of approximately 15% annually in the UK. As a result, manufacturers are focusing on developing advanced electrophysiology devices that cater to this demand. The shift towards outpatient care further supports this trend, as hospitals aim to enhance patient throughput while maintaining high-quality care. Consequently, the electrophysiology market is likely to experience robust growth as these procedures become more commonplace in clinical practice.

Technological Innovations in Electrophysiology Devices

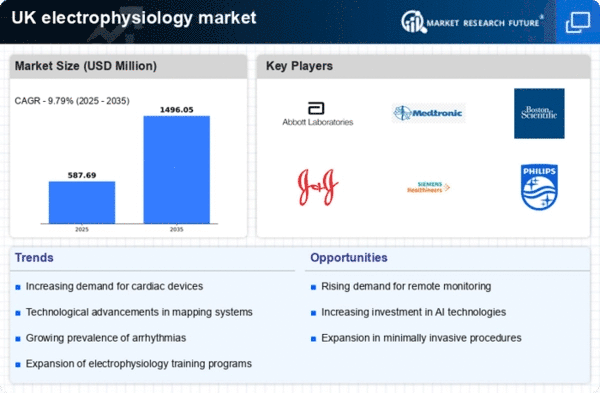

Technological advancements in electrophysiology devices are significantly influencing the market landscape. Innovations such as 3D mapping systems and advanced imaging techniques are enhancing the precision and efficacy of electrophysiological procedures. The introduction of robotic-assisted systems has also improved procedural outcomes, leading to a higher adoption rate among healthcare professionals. In the UK, the market for electrophysiology devices is projected to grow at a CAGR of around 10% over the next five years, driven by these technological innovations. As healthcare providers seek to improve patient outcomes and operational efficiency, the demand for cutting-edge electrophysiology devices is expected to rise, thereby propelling the growth of the electrophysiology market.