Rising Demand for Diagnostic Imaging

The increasing demand for diagnostic imaging in Spain is a primary driver of the contrast media market. As healthcare providers strive to enhance patient outcomes, the utilization of advanced imaging techniques such as MRI and CT scans has surged. This trend is reflected in the growing number of imaging procedures performed annually, which has been estimated to reach over 20 million by 2025. Consequently, the need for effective contrast agents to improve image clarity and diagnostic accuracy is paramount. The contrast media market is likely to benefit from this heightened demand, as healthcare facilities invest in state-of-the-art imaging technologies to meet patient needs.

Aging Population and Healthcare Needs

Spain's aging population is a significant factor influencing the contrast media market. With approximately 19% of the population aged 65 and older, the prevalence of age-related health conditions necessitates advanced diagnostic imaging. This demographic shift is expected to drive the demand for contrast media, as older adults often require more frequent imaging studies for conditions such as cardiovascular diseases and cancers. The contrast media market is poised to expand as healthcare systems adapt to the increasing need for effective diagnostic tools tailored to this demographic. The market could see a growth rate of around 5% annually, reflecting the rising healthcare demands of the elderly.

Investment in Healthcare Infrastructure

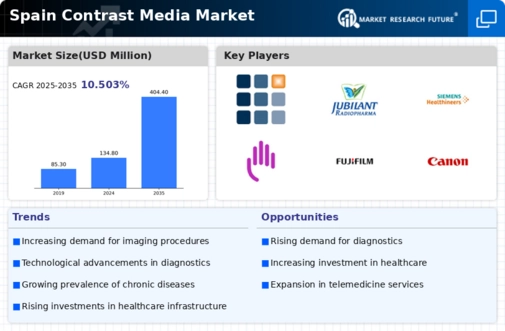

The Spanish government's commitment to enhancing healthcare infrastructure plays a crucial role in the growth of the contrast media market. Recent investments have focused on modernizing hospitals and diagnostic centers, which include the acquisition of advanced imaging equipment. This modernization is expected to increase the number of imaging procedures performed, thereby boosting the demand for contrast agents. The contrast media market stands to gain from these infrastructural improvements, as they facilitate the adoption of innovative imaging technologies. With an estimated investment of €1 billion in healthcare infrastructure over the next five years, the market is likely to experience substantial growth.

Growing Awareness of Preventive Healthcare

There is a notable increase in awareness regarding preventive healthcare among the Spanish population, which is driving the contrast media market. As individuals become more proactive about their health, there is a corresponding rise in routine health screenings and diagnostic imaging. This trend is particularly evident in urban areas, where access to healthcare services is more readily available. The contrast media market is expected to benefit from this shift, as more patients seek imaging studies to detect potential health issues early. The market could see an increase in demand for contrast agents, potentially leading to a growth rate of 4% annually.

Technological Innovations in Contrast Agents

Technological innovations in the development of contrast agents are significantly impacting the contrast media market. Advances in formulations and delivery methods have led to the creation of safer and more effective contrast agents, which enhance imaging quality while minimizing adverse effects. The contrast media market is likely to experience growth as healthcare providers adopt these new technologies to improve patient safety and diagnostic accuracy. With ongoing research and development efforts, the market could see the introduction of novel agents that cater to specific imaging needs, further driving demand in the coming years.