Rising Demand for Diagnostic Imaging

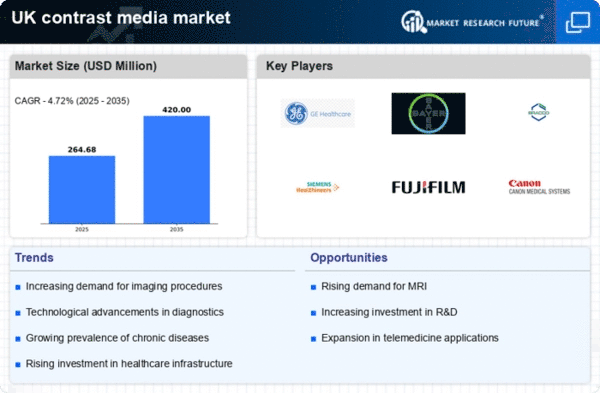

The increasing prevalence of chronic diseases in the UK is driving the demand for diagnostic imaging, which in turn fuels the growth of the contrast media market. As healthcare providers seek to enhance diagnostic accuracy, the use of advanced imaging techniques such as MRI and CT scans has become more prevalent. According to recent data, the imaging market is projected to grow at a CAGR of approximately 5.2% over the next five years. This growth is likely to be accompanied by a corresponding rise in the use of contrast agents, which are essential for improving image clarity and diagnostic outcomes. The contrast media market is thus positioned to benefit from this upward trend, as healthcare facilities invest in state-of-the-art imaging technologies to meet patient needs.

Expansion of Healthcare Infrastructure

The ongoing expansion of healthcare infrastructure in the UK is a key driver for the contrast media market. As new hospitals and imaging centers are established, the demand for contrast agents is expected to rise. Recent investments in healthcare facilities, amounting to over £1 billion, are aimed at enhancing diagnostic capabilities and improving patient care. This expansion is likely to create new opportunities for the contrast media market, as healthcare providers seek to equip their facilities with the latest imaging technologies. Furthermore, the integration of advanced imaging systems into routine clinical practice is anticipated to increase the utilization of contrast agents, thereby driving market growth.

Regulatory Support for Innovative Products

The UK regulatory environment is increasingly supportive of innovation in the healthcare sector, particularly in the contrast media market. Regulatory bodies are streamlining approval processes for new contrast agents, which encourages manufacturers to invest in research and development. This support is crucial as it allows for the introduction of novel products that can enhance patient safety and diagnostic efficacy. For instance, the recent approval of several new contrast agents has the potential to expand the market significantly. The contrast media market is likely to see a surge in product offerings, which could lead to increased competition and improved patient outcomes. This regulatory landscape fosters an environment conducive to growth and innovation.

Growing Awareness of Early Disease Detection

There is a notable increase in public awareness regarding the importance of early disease detection in the UK. This awareness is influencing patient behavior, leading to a higher demand for diagnostic imaging services. As individuals become more proactive about their health, the utilization of imaging techniques that require contrast agents is likely to rise. The contrast media market stands to benefit from this trend, as healthcare providers adapt to meet the growing demand for early diagnosis. Educational campaigns and initiatives aimed at promoting health screenings are expected to further bolster the market, as they encourage patients to seek timely medical evaluations.

Technological Integration in Imaging Systems

The integration of advanced technologies in imaging systems is transforming the landscape of the contrast media market. Innovations such as artificial intelligence and machine learning are enhancing the capabilities of imaging modalities, leading to improved diagnostic accuracy. These technologies facilitate the efficient use of contrast agents, optimizing their application in various imaging procedures. As healthcare facilities in the UK adopt these advanced systems, the demand for high-quality contrast media is likely to increase. The contrast media market is poised to capitalize on this trend, as manufacturers develop products that align with the evolving technological landscape, ensuring that healthcare providers can deliver superior diagnostic services.