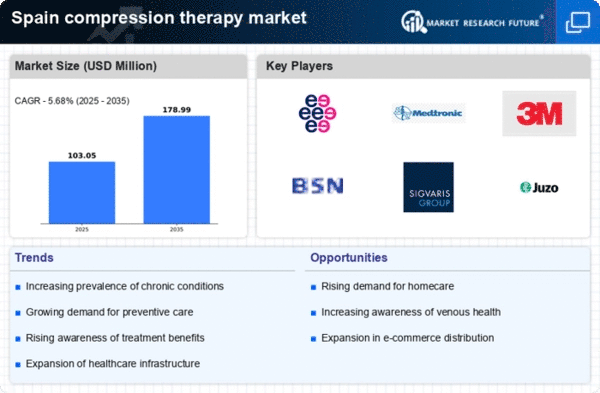

Growth of E-commerce and Online Retail

The expansion of e-commerce platforms in Spain is transforming the compression therapy market. Consumers are increasingly turning to online shopping for medical supplies, including compression garments, due to the convenience and accessibility it offers. This shift is evidenced by a reported 25% increase in online sales of healthcare products over the past year. E-commerce allows for a broader reach, enabling manufacturers and retailers to cater to diverse consumer needs. As online shopping continues to gain traction, it is likely to enhance market penetration and foster competition among providers in the compression therapy market.

Increasing Awareness of Venous Disorders

The rising awareness of venous disorders among the Spanish population is a crucial driver for the compression therapy market. Educational campaigns and healthcare initiatives have highlighted the importance of early detection and management of conditions such as chronic venous insufficiency and varicose veins. As a result, more individuals are seeking preventive measures, including compression therapy. This trend is reflected in the growing number of patients diagnosed with venous disorders, which has increased by approximately 15% over the past few years. Consequently, healthcare providers are increasingly recommending compression garments as part of treatment plans, thereby expanding the market's reach and potential.

Government Initiatives and Healthcare Policies

Government initiatives aimed at improving healthcare access and quality in Spain are positively influencing the compression therapy market. Policies promoting preventive care and chronic disease management are encouraging healthcare providers to incorporate compression therapy into treatment protocols. Recent reforms have allocated additional funding for medical supplies, including compression garments, which could lead to a market growth of approximately 12% in the coming years. These initiatives not only enhance patient outcomes but also stimulate demand for innovative compression solutions, thereby benefiting the overall market.

Aging Population and Increased Healthcare Needs

Spain's demographic shift towards an aging population significantly impacts the compression therapy market. With approximately 19% of the population aged 65 and older, the demand for healthcare services, including compression therapy, is on the rise. Older adults are more susceptible to venous disorders, necessitating effective management strategies. This demographic trend suggests a potential market growth of around 10% annually as healthcare providers focus on tailored solutions for this age group. Compression therapy is increasingly recognized as a vital component in managing age-related health issues, thus driving market expansion.

Rising Sports Participation and Injury Management

The increasing participation in sports and physical activities in Spain is driving demand for compression therapy products. Athletes and fitness enthusiasts are increasingly utilizing compression garments to enhance performance and aid recovery. This trend is supported by a growing body of evidence suggesting that compression therapy can reduce muscle soreness and improve circulation. The sports sector's expansion, coupled with a heightened focus on injury prevention, indicates a potential market growth of around 8% annually. As more individuals recognize the benefits of compression therapy in sports, the market is likely to experience sustained growth.