Rising Sports Participation

The increasing participation in sports and fitness activities in South Korea is driving the demand for compression therapy products. Athletes and fitness enthusiasts are increasingly aware of the benefits of compression garments, which are known to enhance performance and aid in recovery. Recent surveys indicate that over 40% of South Koreans engage in regular physical activity, leading to a heightened interest in products that can support athletic performance. This trend suggests that the compression therapy market could see a surge in sales as more individuals seek out compression wear to prevent injuries and improve recovery times. Furthermore, the endorsement of compression therapy by sports professionals and fitness influencers may further legitimize its use, potentially expanding its appeal beyond traditional medical applications.

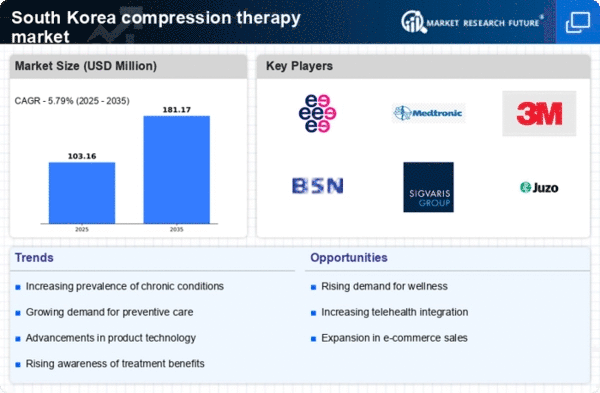

Growth of E-commerce Platforms

The expansion of e-commerce platforms in South Korea is significantly impacting the compression therapy market. With the increasing preference for online shopping, consumers are more inclined to purchase compression therapy products through digital channels. This shift is supported by data indicating that online retail sales in South Korea have surged by over 20% in recent years. E-commerce provides consumers with greater access to a variety of compression therapy options, including specialized products that may not be available in local stores. Additionally, the convenience of home delivery and the ability to compare prices and features online are likely to enhance consumer engagement with the compression therapy market. As a result, manufacturers and retailers are expected to invest more in online marketing strategies to capture this growing segment of the market.

Increasing Prevalence of Chronic Conditions

The rising incidence of chronic conditions such as diabetes and obesity in South Korea is a notable driver for the compression therapy market. As these conditions often lead to complications like venous insufficiency and lymphedema, the demand for effective treatment options is increasing. According to recent health statistics, approximately 30% of the adult population in South Korea is classified as obese, which correlates with a heightened need for compression therapy solutions. This trend suggests that healthcare providers are likely to recommend compression therapy as a preventive and therapeutic measure, thereby expanding the market. Furthermore, the aging population, which is projected to reach 20% by 2025, is expected to further fuel the demand for compression therapy products, as older adults are more susceptible to circulatory issues.

Increased Awareness of Preventive Healthcare

The growing emphasis on preventive healthcare in South Korea is a significant driver for the compression therapy market. As healthcare professionals advocate for proactive measures to maintain health, compression therapy is increasingly recognized for its role in preventing venous disorders and improving circulation. Public health campaigns and educational initiatives are likely contributing to this awareness, encouraging individuals to consider compression therapy as part of their wellness routines. Data suggests that nearly 60% of South Koreans are now prioritizing preventive health measures, which could lead to a substantial increase in the adoption of compression therapy products. This trend indicates a shift in consumer behavior, where individuals are more willing to invest in products that promote long-term health benefits.

Technological Innovations in Product Development

Technological advancements in the design and manufacturing of compression therapy products are likely to propel the market forward. Innovations such as smart textiles and adjustable compression levels are becoming more prevalent, enhancing the effectiveness and comfort of these products. For instance, the introduction of wearable technology that monitors blood flow and adjusts compression accordingly could revolutionize the compression therapy market. As consumers become more discerning about product quality and functionality, manufacturers are expected to invest in research and development to create more sophisticated solutions. This focus on innovation may not only improve patient outcomes but also attract a broader customer base, including those seeking preventive care and wellness solutions.