Growing Patient Awareness and Demand

There is a notable increase in patient awareness regarding the benefits of advanced dental imaging technologies in Spain. Patients are becoming more informed about the advantages of CBCT scans, such as reduced radiation exposure and improved diagnostic capabilities. This heightened awareness is driving demand for CBCT services among dental practices. According to recent surveys, approximately 60% of patients express a preference for clinics that utilize advanced imaging technologies. Consequently, the Spain CBCT dental market is witnessing a shift in patient expectations, compelling dental professionals to invest in CBCT systems to remain competitive. This trend is likely to contribute to the overall growth of the market.

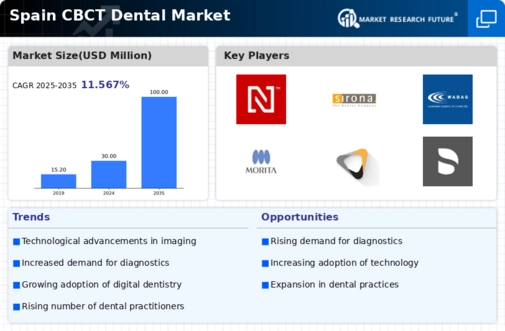

Technological Advancements in Imaging

The Spain CBCT dental market is experiencing a surge in technological advancements that enhance imaging capabilities. Innovations such as high-resolution imaging and faster scanning times are becoming increasingly prevalent. These advancements not only improve diagnostic accuracy but also streamline treatment planning processes. For instance, the integration of artificial intelligence in imaging software is likely to facilitate more precise interpretations of scans. As a result, dental professionals in Spain are increasingly adopting CBCT technology, leading to a projected market growth rate of approximately 8% annually. This trend indicates a robust demand for advanced imaging solutions, positioning the Spain CBCT dental market for sustained expansion.

Integration of CBCT in Dental Education

The integration of CBCT technology into dental education programs in Spain is significantly influencing the Spain CBCT dental market. Educational institutions are increasingly incorporating CBCT training into their curricula, ensuring that future dental professionals are well-versed in advanced imaging techniques. This educational emphasis is likely to create a skilled workforce adept at utilizing CBCT systems effectively. As graduates enter the workforce, they are expected to advocate for the adoption of these technologies in their practices. This trend may lead to a more widespread acceptance of CBCT in the dental community, further propelling the growth of the Spain CBCT dental market.

Rising Demand for Orthodontic Applications

The Spain CBCT dental market is witnessing a rising demand for orthodontic applications of CBCT technology. Orthodontists are increasingly utilizing CBCT scans for treatment planning and monitoring, as these scans provide detailed three-dimensional images of dental structures. This capability is particularly beneficial for complex cases, where traditional imaging methods may fall short. The orthodontic segment is projected to account for a significant share of the market, driven by the growing prevalence of orthodontic treatments among patients. As a result, dental practices are likely to invest in CBCT systems to meet this demand, thereby contributing to the overall growth of the Spain CBCT dental market.

Regulatory Support for Advanced Technologies

The regulatory landscape in Spain is evolving to support the adoption of advanced dental technologies, including CBCT systems. The Spanish Agency of Medicines and Medical Devices (AEMPS) has established guidelines that promote the safe and effective use of these technologies. This regulatory support is crucial for manufacturers and dental practitioners, as it ensures compliance with safety standards while encouraging innovation. The Spain CBCT dental market benefits from these regulations, as they foster a conducive environment for the introduction of new products. Furthermore, the alignment with European Union regulations enhances market access for international manufacturers, potentially increasing competition and driving down costs for dental practices.