Focus on Preventive Dentistry

The Spain CBCT dental imaging market is aligning with the growing focus on preventive dentistry. As dental professionals emphasize early detection and intervention, the role of advanced imaging technologies becomes increasingly critical. CBCT imaging allows for comprehensive assessments of dental health, enabling practitioners to identify potential issues before they escalate. This proactive approach is gaining traction among both dentists and patients, as it can lead to better long-term outcomes and reduced treatment costs. The Spanish dental community is actively promoting preventive care, which may drive the adoption of CBCT systems in routine examinations. As a result, the emphasis on preventive dentistry is likely to contribute to the expansion of the Spain CBCT dental imaging market.

Regulatory Support and Standards

The Spain CBCT dental imaging market benefits from robust regulatory support and established standards that ensure the safety and efficacy of imaging technologies. The Spanish Agency of Medicines and Medical Devices (AEMPS) plays a crucial role in overseeing the approval and monitoring of medical devices, including CBCT systems. As of January 2026, compliance with these regulations is essential for manufacturers and practitioners alike. The presence of clear guidelines fosters trust among dental professionals and patients, potentially leading to increased utilization of CBCT imaging. Moreover, adherence to international standards, such as those set by the International Organization for Standardization (ISO), further enhances the credibility of the Spain CBCT dental imaging market. This regulatory framework is likely to encourage innovation while ensuring patient safety.

Technological Advancements in Imaging

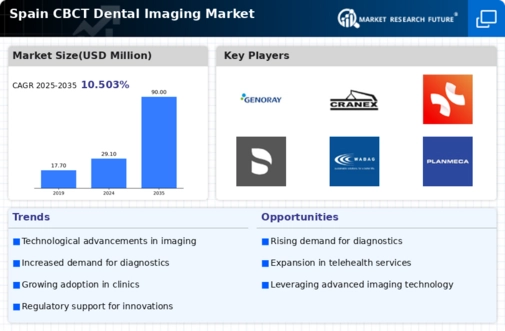

The Spain CBCT dental imaging market is experiencing a surge in technological advancements that enhance diagnostic capabilities. Innovations such as improved image resolution and faster scanning times are becoming standard. For instance, the integration of artificial intelligence in image analysis is streamlining workflows and increasing accuracy. As of January 2026, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 8%, driven by these advancements. Furthermore, the introduction of portable CBCT units is making imaging more accessible in various settings, including smaller dental practices. This trend indicates a shift towards more efficient and effective diagnostic tools, which could potentially reshape the landscape of dental imaging in Spain.

Increased Adoption by Dental Practices

The Spain CBCT dental imaging market is witnessing a notable increase in adoption rates among dental practices. As practitioners recognize the benefits of 3D imaging for treatment planning and patient education, the demand for CBCT systems is rising. Recent data suggests that over 60% of dental clinics in urban areas have integrated CBCT technology into their practices. This trend is likely influenced by the growing emphasis on precision in dental procedures, such as implants and orthodontics. Additionally, the Spanish government has been promoting digital dentistry through various initiatives, which may further encourage practices to invest in advanced imaging technologies. This widespread adoption is expected to drive market growth and enhance the overall quality of dental care in Spain.

Growing Demand for Orthodontic Treatments

The Spain CBCT dental imaging market is significantly influenced by the growing demand for orthodontic treatments. As more individuals seek orthodontic care, the need for precise imaging to assess dental structures becomes paramount. Recent statistics indicate that orthodontic procedures have increased by approximately 15% in the past year, highlighting a shift in consumer preferences towards aesthetic dental solutions. CBCT imaging provides orthodontists with detailed 3D views of the patient's anatomy, facilitating better treatment planning and outcomes. This trend is expected to continue, as the Spanish population becomes increasingly aware of the benefits of orthodontic treatments. Consequently, the rising demand for orthodontics is likely to propel the growth of the CBCT dental imaging market in Spain.