Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in Spain is significantly influencing the cardiac imaging software market. The Spanish government has committed to enhancing healthcare facilities, which includes upgrading diagnostic equipment and software. This initiative is expected to result in an increase in healthcare spending, projected to reach €200 billion by 2026. As hospitals and clinics modernize their imaging capabilities, the demand for advanced cardiac imaging software is likely to escalate. This investment not only aims to improve patient care but also to streamline operational efficiencies within healthcare systems. The cardiac imaging-software market stands to gain from these infrastructural developments, as they create opportunities for software vendors to provide innovative solutions tailored to the evolving needs of healthcare providers.

Rising Demand for Personalized Medicine

The shift towards personalized medicine is emerging as a significant driver for the cardiac imaging-software market. In Spain, there is a growing emphasis on tailoring treatment plans based on individual patient profiles, which necessitates advanced imaging techniques. Personalized medicine relies heavily on accurate imaging data to inform clinical decisions, thereby increasing the demand for sophisticated software solutions. The market is expected to grow by approximately 6% annually as healthcare providers seek to implement personalized approaches in cardiac care. This trend not only enhances patient outcomes but also aligns with the broader movement towards precision medicine in the healthcare sector. As a result, the cardiac imaging-software market is likely to expand in response to this evolving paradigm.

Increased Focus on Training and Education

The cardiac imaging software market is also being driven by an increased focus on training and education for healthcare professionals. In Spain, there is a concerted effort to enhance the skills of radiologists and cardiologists in utilizing advanced imaging technologies. Educational programs and workshops are being implemented to ensure that practitioners are well-versed in the latest software applications. This emphasis on training is crucial, as it directly impacts the effective use of cardiac imaging software in clinical practice. As healthcare professionals become more proficient in these technologies, the demand for advanced imaging solutions is likely to rise. Consequently, this focus on education and training is expected to contribute positively to the growth of the cardiac imaging-software market.

Growing Prevalence of Cardiovascular Diseases

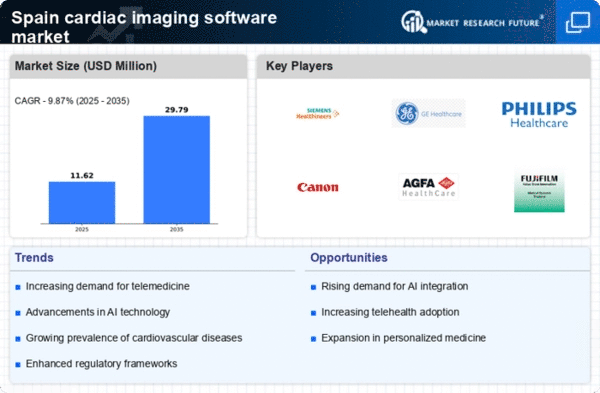

The rising prevalence of cardiovascular diseases in Spain is a critical driver for the cardiac imaging software market. Statistics indicate that cardiovascular diseases account for nearly 30% of all deaths in the country, highlighting the urgent need for effective diagnostic tools. As healthcare systems prioritize early detection and intervention, the demand for advanced imaging software is expected to rise. This market is projected to reach a valuation of €500 million by 2027, reflecting a compound annual growth rate (CAGR) of 7%. The increasing burden of cardiovascular diseases compels healthcare providers to invest in state-of-the-art imaging solutions, thereby propelling the growth of the cardiac imaging-software market. Consequently, the focus on preventive healthcare and improved patient management strategies further underscores the importance of this market.

Technological Advancements in Imaging Techniques

The cardiac imaging-software market is experiencing a surge due to rapid technological advancements in imaging techniques. Innovations such as 3D imaging, enhanced resolution, and real-time imaging capabilities are transforming diagnostic processes. In Spain, the adoption of advanced imaging modalities is projected to increase, with a market growth rate of approximately 8% annually. These advancements not only improve diagnostic accuracy but also enhance patient outcomes, thereby driving demand for sophisticated software solutions. As healthcare providers seek to integrate these technologies into their practices, the cardiac imaging-software market is likely to benefit significantly from this trend. Furthermore, the increasing complexity of cardiac conditions necessitates the use of advanced imaging software, which is becoming indispensable in clinical settings.