Government Initiatives and Funding

Government initiatives and funding play a crucial role in shaping the cardiac imaging-software market. In Japan, the government has been actively promoting healthcare innovation through various funding programs aimed at enhancing medical technology. These initiatives are designed to support research and development in imaging software, thereby fostering advancements in diagnostic capabilities. For example, the Japanese government has allocated substantial budgets to improve healthcare infrastructure, which includes investments in imaging technologies. This financial backing is expected to stimulate growth in the cardiac imaging-software market, as companies leverage these resources to develop innovative solutions that meet the evolving needs of healthcare providers.

Increased Focus on Preventive Healthcare

An increased focus on preventive healthcare is significantly impacting the cardiac imaging-software market. In Japan, there is a growing awareness of the importance of early detection and prevention of cardiovascular diseases. This shift in healthcare philosophy is driving demand for advanced imaging solutions that enable proactive monitoring of heart health. As healthcare providers emphasize preventive measures, the cardiac imaging-software market is likely to expand, with a focus on tools that facilitate regular screenings and assessments. The integration of imaging software into routine health check-ups is expected to enhance patient engagement and promote healthier lifestyles, further propelling market growth.

Rising Cardiovascular Disease Prevalence

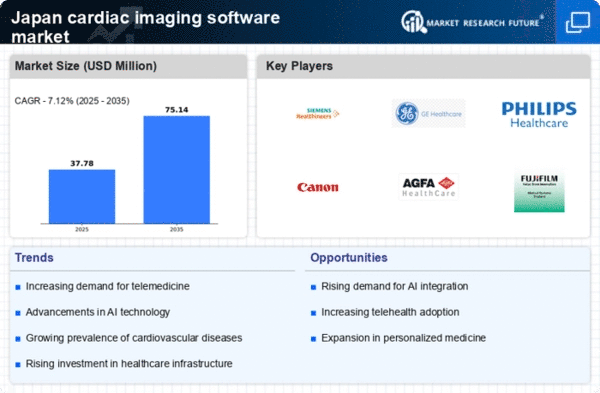

The increasing prevalence of cardiovascular diseases in Japan is a primary driver for the cardiac imaging-software market. As the population ages, the incidence of heart-related ailments is expected to rise, necessitating advanced imaging solutions for accurate diagnosis and treatment. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in Japan, highlighting the urgent need for effective imaging technologies. This growing demand for diagnostic tools is likely to propel investments in cardiac imaging-software, as healthcare providers seek to enhance patient outcomes through early detection and intervention. Consequently, the cardiac imaging-software market is poised for substantial growth, driven by the need to address the escalating burden of cardiovascular diseases.

Growing Demand for Telemedicine Solutions

The growing demand for telemedicine solutions is emerging as a significant driver for the cardiac imaging-software market. As healthcare providers in Japan increasingly adopt remote monitoring and consultation practices, the need for effective imaging software that supports telehealth services is becoming paramount. This shift towards telemedicine is likely to enhance access to cardiac care, particularly for patients in rural or underserved areas. The cardiac imaging-software market is expected to benefit from this trend, as software solutions that facilitate remote imaging and diagnostics become essential tools for healthcare professionals. Consequently, the integration of telemedicine capabilities into imaging software is anticipated to drive market growth.

Technological Advancements in Imaging Techniques

Technological advancements in imaging techniques are significantly influencing the cardiac imaging-software market. Innovations such as 3D imaging, real-time visualization, and enhanced image processing capabilities are transforming how cardiovascular conditions are diagnosed and monitored. In Japan, the integration of cutting-edge technologies into imaging software is expected to improve diagnostic accuracy and efficiency. For instance, the adoption of advanced algorithms and machine learning techniques can enhance image quality and reduce interpretation time. As healthcare facilities increasingly invest in state-of-the-art imaging solutions, the cardiac imaging-software market is likely to experience robust growth, driven by the demand for more precise and efficient diagnostic tools.