Expansion of Telemedicine Services

The expansion of telemedicine services in South Korea is significantly influencing the cardiac imaging-software market. As healthcare providers increasingly adopt telehealth solutions, there is a growing need for software that supports remote imaging consultations and diagnostics. This trend is particularly relevant in the context of cardiac care, where timely access to imaging results can be critical for patient management. The market is likely to see a growth rate of around 5% as telemedicine becomes more integrated into routine healthcare practices. The ability to share imaging data securely and efficiently through telemedicine platforms enhances collaboration among healthcare professionals, ultimately improving patient care. This shift towards remote healthcare services is expected to drive demand for advanced cardiac imaging software that can seamlessly integrate with telehealth systems, thereby fostering growth in the market.

Growing Focus on Personalized Medicine

The shift towards personalized medicine is emerging as a pivotal driver for the cardiac imaging-software market. In South Korea, healthcare providers are increasingly recognizing the importance of tailoring treatment plans to individual patient needs. This approach necessitates advanced imaging software capable of providing detailed insights into a patient's unique cardiac condition. As a result, there is a growing demand for software solutions that integrate genetic, clinical, and imaging data to facilitate personalized treatment strategies. The market is anticipated to grow at a rate of approximately 6% annually, as healthcare professionals seek tools that enhance their ability to deliver customized care. This focus on personalized medicine not only improves patient outcomes but also drives the adoption of innovative cardiac imaging software, thereby contributing to the overall growth of the market.

Rising Investment in Healthcare Infrastructure

The cardiac imaging-software market is benefiting from substantial investments in healthcare infrastructure across South Korea. The government and private sector are increasingly allocating funds to modernize healthcare facilities, which includes upgrading imaging equipment and software. This investment trend is evident in the establishment of new hospitals and the renovation of existing ones, aimed at enhancing diagnostic capabilities. As healthcare providers upgrade their imaging systems, the demand for advanced cardiac imaging software is expected to rise. Reports indicate that the healthcare expenditure in South Korea is projected to reach approximately $200 billion by 2026, with a significant portion directed towards imaging technologies. This influx of capital is likely to stimulate growth in the cardiac imaging-software market, as facilities seek to implement cutting-edge solutions that improve diagnostic accuracy and operational efficiency.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases (CVDs) in South Korea is a critical driver for the cardiac imaging-software market. According to recent health statistics, CVDs account for a significant portion of mortality rates in the country, prompting healthcare systems to prioritize early detection and intervention. This alarming trend has led to an increased demand for advanced imaging solutions that facilitate accurate diagnosis and treatment planning. As healthcare providers seek to enhance their diagnostic capabilities, the adoption of cardiac imaging software is likely to rise. The market is expected to witness a growth rate of around 7% annually, as hospitals and clinics invest in software that supports comprehensive cardiac assessments. This focus on addressing the growing burden of CVDs is essential for improving patient care and outcomes, thereby driving the cardiac imaging-software market.

Technological Advancements in Imaging Techniques

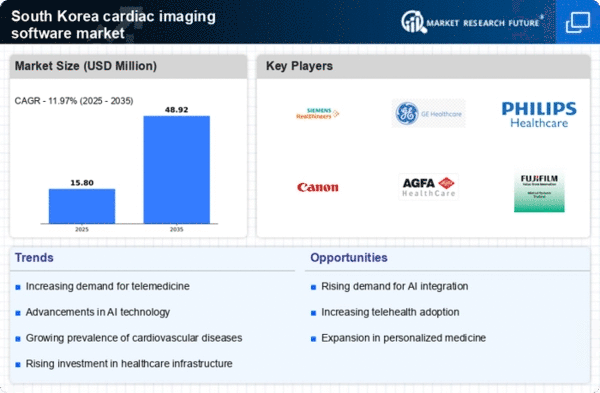

The market is experiencing a surge due to rapid technological advancements in imaging techniques. Innovations such as 3D imaging, real-time visualization, and enhanced resolution are transforming diagnostic capabilities. In South Korea, the integration of advanced imaging modalities, including MRI and CT scans, is becoming increasingly prevalent. This trend is supported by a growing number of healthcare facilities adopting state-of-the-art imaging technologies. As a result, the demand for sophisticated cardiac imaging software that can process and analyze complex data is on the rise. The market is projected to grow at a CAGR of approximately 8% over the next five years, driven by these technological improvements. Consequently, healthcare providers are investing in software solutions that enhance diagnostic accuracy and improve patient outcomes, thereby propelling the cardiac imaging-software market forward.