Focus on Natural Ingredients

There is a growing trend towards the use of natural ingredients in food and health products, which is positively influencing the prebiotics market. South Korean consumers are increasingly concerned about the quality and source of the ingredients in their food. This has led to a demand for prebiotic products that are derived from natural sources, such as fruits, vegetables, and whole grains. Market Research Future indicates that products labeled as 'natural' or 'organic' are experiencing higher sales growth compared to conventional options. This trend suggests that manufacturers in the prebiotics market may need to prioritize the use of natural ingredients in their formulations to meet consumer preferences and enhance their competitive edge.

Rising Awareness of Gut Health

The prebiotics market is benefiting from a significant increase in consumer awareness regarding gut health. Educational campaigns and health initiatives have highlighted the role of prebiotics in maintaining a healthy digestive system. This awareness is reflected in the growing sales of prebiotic supplements and functional foods. Recent statistics show that the sales of prebiotic products in South Korea have increased by approximately 15% in the last year alone. As consumers become more informed about the benefits of prebiotics, it is likely that demand will continue to rise, further propelling the growth of the prebiotics market. This trend indicates a shift towards preventive health measures, with consumers actively seeking products that support their digestive health.

Aging Population and Health Needs

South Korea's demographic shift towards an aging population is significantly impacting the prebiotics market. As the elderly population grows, there is an increasing focus on health management and disease prevention. Older adults are more susceptible to digestive issues, which has led to a heightened interest in prebiotic products that promote gut health. Market data indicates that the segment of consumers aged 60 and above is expected to account for over 25% of the total prebiotics market by 2027. This demographic trend suggests that companies may need to tailor their marketing strategies and product formulations to cater to the specific health needs of older consumers, thereby driving growth in the prebiotics market.

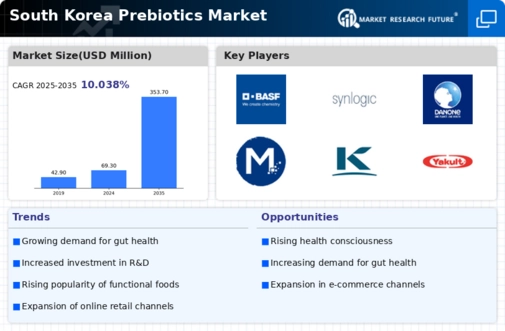

Expansion of E-commerce Platforms

The prebiotics market is witnessing a transformation due to the rapid expansion of e-commerce platforms in South Korea. Online shopping has become increasingly popular, providing consumers with convenient access to a wide range of prebiotic products. This shift in purchasing behavior is particularly evident among younger consumers who prefer the convenience of online shopping. Data suggests that e-commerce sales of health products, including prebiotics, have grown by over 20% in the past year. This trend indicates that companies in the prebiotics market may need to enhance their online presence and marketing strategies to capture the growing segment of online shoppers, thereby driving sales and market growth.

Increasing Demand for Functional Foods

The prebiotics market in South Korea is experiencing a notable surge in demand for functional foods. Consumers are increasingly seeking products that offer health benefits beyond basic nutrition. This trend is driven by a growing awareness of the importance of gut health and its connection to overall well-being. According to recent data, the functional food sector is projected to grow at a CAGR of approximately 8% over the next five years. This growth is likely to bolster the prebiotics market, as manufacturers innovate to incorporate prebiotic ingredients into various food products, including dairy, snacks, and beverages. The rising interest in health-enhancing foods suggests that the prebiotics market will continue to expand as consumers prioritize their health and wellness.