Rising Popularity of Plant-Based Diets

The Canada Prebiotics Market is witnessing a shift towards plant-based diets, which is significantly influencing the demand for prebiotic ingredients. As more Canadians adopt vegetarian and vegan lifestyles, the need for plant-derived prebiotics is on the rise. Ingredients such as inulin and fructooligosaccharides, commonly found in fruits and vegetables, are gaining traction among health-conscious consumers. This trend is supported by market data indicating that the plant-based food sector in Canada is expected to reach CAD 4.4 billion by 2025. Consequently, the integration of prebiotics into plant-based products is likely to enhance their appeal, further driving the growth of the prebiotics market.

Regulatory Support for Functional Foods

The Canada Prebiotics Market benefits from robust regulatory support for functional foods, which includes prebiotics. The Canadian government has established guidelines that encourage the development and marketing of functional food products. This regulatory framework not only ensures safety and efficacy but also promotes innovation within the industry. For instance, Health Canada has recognized the health claims associated with prebiotics, which may enhance consumer trust and acceptance. As a result, manufacturers are increasingly investing in research and development to create new prebiotic formulations, thereby expanding their product offerings and contributing to market growth.

Growing Health Consciousness Among Consumers

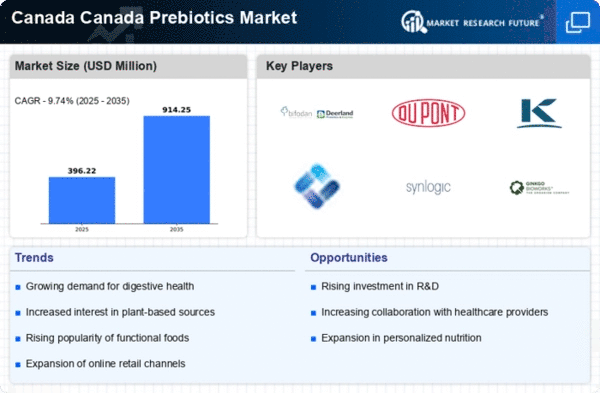

The Canada Prebiotics Market is experiencing a notable surge in demand driven by the increasing health consciousness among consumers. Canadians are becoming more aware of the importance of gut health and its correlation with overall well-being. This trend is reflected in the rising sales of prebiotic products, which are perceived as beneficial for digestive health. According to recent data, the market for prebiotics in Canada is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is likely fueled by consumers seeking natural and functional food ingredients that promote health benefits, thereby enhancing the market landscape for prebiotics.

Expansion of Retail and Distribution Channels

The Canada Prebiotics Market is benefiting from the expansion of retail and distribution channels, which enhances product accessibility for consumers. Traditional retail outlets, health food stores, and online platforms are increasingly offering a wide range of prebiotic products. This diversification in distribution channels is crucial, as it allows consumers to easily access prebiotic supplements and functional foods. Recent statistics indicate that online sales of health products in Canada have surged, with e-commerce expected to account for a significant portion of total sales in the coming years. This trend not only facilitates consumer convenience but also encourages manufacturers to broaden their market reach, thereby contributing to the overall growth of the prebiotics market.

Increased Investment in Research and Development

The Canada Prebiotics Market is characterized by increased investment in research and development (R&D) activities. Companies are recognizing the potential of prebiotics in addressing various health issues, leading to a surge in innovative product development. This focus on R&D is crucial for creating new prebiotic formulations that cater to specific health needs, such as immune support and weight management. Furthermore, collaborations between academic institutions and industry players are fostering advancements in prebiotic research. As a result, the market is likely to see a diversification of prebiotic products, which could attract a broader consumer base and stimulate growth.