Surge in Renewable Energy Adoption

The increasing shift towards renewable energy sources in South Korea is driving the lithium ion-battery market. As the nation aims to reduce its carbon footprint, the integration of solar and wind energy systems necessitates efficient energy storage solutions. Lithium ion batteries are pivotal in this context, providing the necessary storage capacity to manage intermittent energy supply. In 2025, the renewable energy sector is projected to account for approximately 20% of the total energy mix, further enhancing the demand for lithium ion batteries. This trend indicates a robust growth trajectory for the market, as energy storage becomes essential for balancing supply and demand, thereby solidifying the role of lithium ion batteries in the energy transition.

Expansion of Consumer Electronics Market

The burgeoning consumer electronics market in South Korea is a significant driver for the lithium ion-battery market. With the proliferation of smartphones, laptops, and wearable devices, the demand for compact and efficient batteries is escalating. In 2025, the consumer electronics sector is expected to grow by approximately 15%, further fueling the need for advanced lithium ion batteries. This growth is indicative of a broader trend where consumer preferences are shifting towards portable and high-capacity devices. Consequently, manufacturers are compelled to innovate and enhance battery performance, thereby reinforcing the lithium ion-battery market's position within the electronics industry.

Focus on Sustainable Manufacturing Practices

The emphasis on sustainable manufacturing practices is shaping the lithium ion-battery market in South Korea. As environmental regulations become more stringent, manufacturers are increasingly adopting eco-friendly production methods. This shift is not only aimed at compliance but also at meeting consumer expectations for sustainability. In 2025, it is anticipated that around 30% of battery manufacturers will implement green technologies in their production processes. This focus on sustainability could enhance the market's appeal, as consumers and businesses alike prioritize environmentally responsible products. Consequently, the lithium ion-battery market is likely to experience growth driven by these sustainable practices.

Technological Innovations in Battery Manufacturing

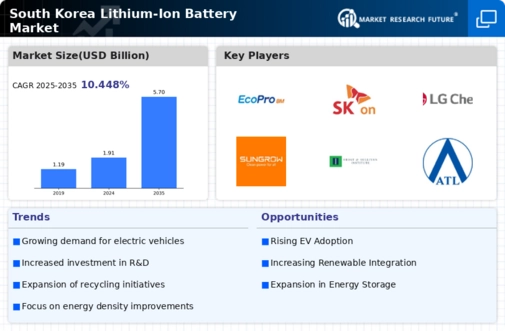

Technological advancements in battery manufacturing processes are significantly impacting the lithium ion-battery market. Innovations such as solid-state batteries and enhanced recycling techniques are emerging, which could potentially improve battery efficiency and lifespan. In South Korea, companies are investing heavily in R&D, with expenditures reaching around $1 billion in 2025, aimed at developing next-generation battery technologies. These innovations not only enhance performance but also address environmental concerns associated with battery disposal. As manufacturers strive to meet the growing demand for high-performance batteries, the lithium ion-battery market is likely to experience substantial growth driven by these technological breakthroughs.

Increased Investment in Electric Mobility Solutions

The rising investment in electric mobility solutions is a crucial factor influencing the lithium ion-battery market. South Korea's commitment to developing electric public transportation and personal vehicles is evident, with government initiatives promoting electric vehicle adoption. By 2025, the electric vehicle market is projected to grow by 25%, necessitating a corresponding increase in battery production. This surge in demand for electric vehicles is likely to drive innovations in battery technology, as manufacturers seek to enhance energy density and reduce costs. The lithium ion-battery market stands to benefit significantly from this trend, as it becomes integral to the future of transportation in South Korea.