Focus on Energy Storage Solutions

The inverter market in South Korea is also being driven by the growing focus on energy storage solutions. As the integration of renewable energy sources increases, the need for effective energy storage systems becomes more pronounced. Inverters are essential components in these systems, facilitating the conversion and management of stored energy. The South Korean government is investing in research and development to enhance energy storage technologies, which is expected to create new opportunities within the inverter market. Analysts predict that the market for inverters associated with energy storage could expand by approximately 12% in the coming years, reflecting the rising importance of energy resilience.

Rising Demand for Renewable Energy

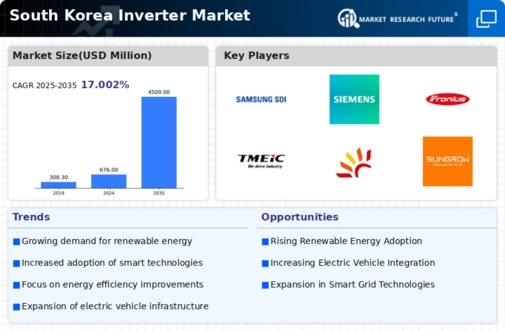

The inverter market in South Korea is experiencing a notable surge in demand driven by the increasing adoption of renewable energy sources. As the government aims to achieve a 20% share of renewable energy in the national energy mix by 2030, the need for efficient inverters becomes paramount. Inverters play a crucial role in converting the direct current generated by solar panels into alternating current for household and industrial use. This transition is essential for integrating renewable energy into the grid. The inverter market is projected to grow at a CAGR of approximately 10% over the next five years, reflecting the growing emphasis on sustainable energy solutions.

Government Incentives for Energy Efficiency

The South Korean government is actively promoting energy efficiency through various incentives, which is positively influencing the inverter market. Programs that provide financial support for the installation of energy-efficient systems, including inverters, are encouraging both residential and commercial sectors to invest in modern energy solutions. For instance, subsidies and tax rebates for solar energy systems are making it more feasible for consumers to adopt inverters. This trend is expected to drive the inverter market, with an anticipated growth rate of around 8% annually as more stakeholders recognize the long-term cost savings associated with energy-efficient technologies.

Increasing Urbanization and Electrification

Urbanization in South Korea is leading to a higher demand for electricity, which in turn is propelling the inverter market. As cities expand and populations grow, the need for reliable and efficient energy solutions becomes critical. The rise in electrification, particularly in urban areas, necessitates the deployment of advanced inverter systems to manage the increased load and ensure stable power supply. This trend is likely to result in a robust growth trajectory for the inverter market, with projections indicating a potential increase in market size by 15% over the next few years as urban infrastructure continues to develop.

Technological Innovations in Inverter Design

Innovations in inverter technology are significantly impacting the inverter market in South Korea. The introduction of smart inverters, which offer advanced features such as grid support and real-time monitoring, is enhancing the efficiency and reliability of energy systems. These technological advancements not only improve energy conversion rates but also facilitate better integration with smart grids. As a result, the inverter market is likely to witness an increase in demand for these sophisticated devices. Furthermore, the development of microinverters and power optimizers is expected to cater to the growing need for modular and scalable energy solutions, thereby expanding market opportunities.