South Korea Embedded Graphical User Interface Development Software Market Summary

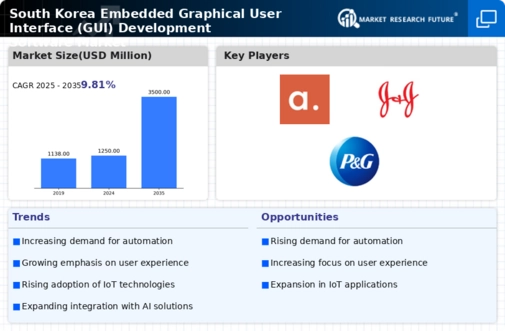

The Global South Korea Embedded Graphical User Interface (GUI) Development Software Market is projected to grow significantly from 1250 USD Million in 2024 to 3500 USD Million by 2035.

Key Market Trends & Highlights

South Korea Embedded Graphical User Interface (GUI) Development Software Key Trends and Highlights

- The market is expected to expand at a compound annual growth rate (CAGR) of 9.81 percent from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 3500 USD Million, indicating robust growth potential.

- In 2024, the market is valued at 1250 USD Million, reflecting a strong foundation for future expansion.

- Growing adoption of advanced technologies due to increasing demand for user-friendly interfaces is a major market driver.

Market Size & Forecast

| 2024 Market Size | 1250 (USD Million) |

| 2035 Market Size | 3500 (USD Million) |

| CAGR (2025 - 2035) | 9.81% |

Major Players

Mentor Graphics, Samsung Electronics, Wind River, Qt Company, ETRI, Siemens, Rohde & Schwarz, LG Electronics, Adobe, Mbed, Microsoft, Altium, Oracle, IBM