Supportive Government Policies

The Indian government has been actively promoting the electronics manufacturing sector through various initiatives, which serves as a significant driver for The India Embedded Graphical User Interface Development Software Market. Programs such as 'Make in India' and 'Digital India' aim to bolster local manufacturing and innovation in technology. These initiatives have led to increased investments in the electronics domain, with the government targeting a production value of USD 300 billion by 2025. This supportive environment encourages software developers to create advanced GUI solutions tailored for embedded systems, thereby enhancing the overall market landscape. As a result, the india embedded graphical user interface development software market is likely to witness substantial growth, driven by the influx of new players and innovative products.

Growing Adoption of IoT Devices

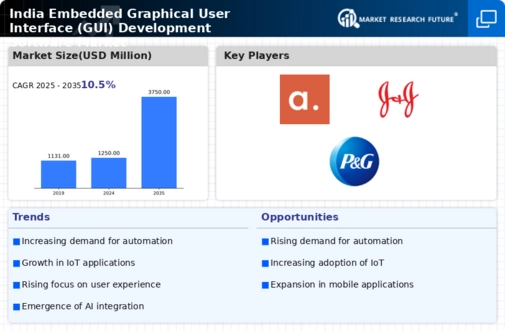

The proliferation of Internet of Things (IoT) devices in India is a pivotal driver for The India Embedded Graphical User Interface Development Software Market. As industries increasingly integrate IoT solutions, the demand for intuitive and responsive graphical user interfaces (GUIs) escalates. According to recent reports, the IoT market in India is projected to reach USD 15 billion by 2025, indicating a robust growth trajectory. This surge necessitates advanced GUI development tools that can cater to diverse applications, from smart homes to industrial automation. Consequently, software developers are compelled to innovate and enhance user experiences, thereby propelling the growth of the india embedded graphical user interface development software market. The emphasis on seamless connectivity and user engagement further underscores the importance of sophisticated GUI solutions in this evolving landscape.

Rising Focus on User Experience

In the current landscape, there is an increasing emphasis on user experience (UX) across various sectors in India, which significantly influences The India Embedded Graphical User Interface Development Software Market. Companies are recognizing that a well-designed GUI can enhance user satisfaction and engagement, leading to higher retention rates. This trend is particularly evident in the mobile application sector, where user-centric designs are paramount. As per industry estimates, the mobile app market in India is expected to grow to USD 7 billion by 2026, highlighting the need for effective GUI development tools. This growing focus on UX compels developers to adopt advanced software solutions that facilitate the creation of visually appealing and functional interfaces, thereby driving the demand for embedded GUI development software in India.

Advancements in Technology and Tools

Technological advancements in software development tools and methodologies are significantly influencing The India Embedded Graphical User Interface Development Software Market. The introduction of frameworks and platforms that facilitate rapid GUI development is enabling developers to create more complex and feature-rich interfaces with greater efficiency. For instance, the adoption of cross-platform development tools is on the rise, allowing for the creation of GUIs that function seamlessly across various devices. This trend is particularly relevant in the context of India's burgeoning software industry, which is projected to reach USD 350 billion by 2025. As developers seek to leverage these advancements, the demand for embedded GUI development software is likely to increase, fostering innovation and enhancing the overall quality of user interfaces in the market.

Emergence of Smart Consumer Electronics

The rise of smart consumer electronics in India is another crucial driver for The India Embedded Graphical User Interface Development Software Market. With the increasing adoption of smart TVs, wearables, and home automation systems, there is a growing need for sophisticated GUIs that can provide seamless user interactions. Market Research Future indicates that the smart home market in India is projected to reach USD 10 billion by 2025, reflecting a burgeoning demand for user-friendly interfaces. This trend compels developers to focus on creating embedded GUI solutions that enhance the functionality and appeal of consumer electronics. As manufacturers strive to differentiate their products in a competitive market, the demand for innovative GUI development software is expected to rise, further propelling the growth of the india embedded graphical user interface development software market.