Rise of Mobile Applications

The proliferation of mobile applications in the GCC region is significantly influencing the embedded graphical user interface development software market. With mobile penetration rates exceeding 90%, developers are increasingly prioritizing the creation of visually appealing and functional interfaces for mobile platforms. This trend is underscored by the fact that mobile app revenues in the GCC are expected to reach USD 1 billion by 2026. As a result, the demand for sophisticated graphical user interface development tools is on the rise, driving innovation and competition within the GCC embedded graphical user interface development software market.

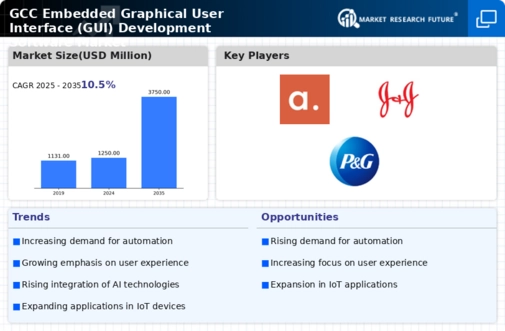

Growing Demand for Smart Devices

The GCC embedded graphical user interface development software market is experiencing a notable surge in demand for smart devices. As consumers increasingly adopt smart home technologies and IoT devices, the need for intuitive and responsive graphical user interfaces becomes paramount. This trend is reflected in the GCC region, where the smart home market is projected to grow at a compound annual growth rate of over 25% through 2026. Consequently, software developers are focusing on creating user-friendly interfaces that enhance the user experience, thereby driving growth in the GCC embedded graphical user interface development software market.

Government Initiatives and Support

Government initiatives across the GCC region are playing a crucial role in fostering the growth of the embedded graphical user interface development software market. Various countries, including the UAE and Saudi Arabia, have launched programs aimed at promoting digital transformation and innovation. For instance, the UAE Vision 2021 emphasizes the importance of advanced technology in enhancing the quality of life. Such policies encourage investments in software development, particularly in the realm of graphical user interfaces, which are essential for modern applications. This supportive environment is likely to propel the GCC embedded graphical user interface development software market forward.

Increased Focus on User Experience

In the GCC embedded graphical user interface development software market, there is a growing emphasis on user experience (UX) design. Companies are recognizing that a well-designed interface can significantly impact user satisfaction and retention. As a result, developers are investing in tools and methodologies that prioritize UX, leading to the creation of more engaging and efficient interfaces. This shift is evident in various sectors, including healthcare and finance, where user-friendly interfaces are essential for effective service delivery. The focus on UX is likely to continue shaping the GCC embedded graphical user interface development software market.

Advancements in Technology and Tools

Technological advancements are driving innovation within the GCC embedded graphical user interface development software market. The introduction of new development frameworks and tools is enabling developers to create more sophisticated and responsive interfaces. For instance, the rise of artificial intelligence and machine learning is facilitating the development of adaptive interfaces that can learn from user behavior. This trend is particularly relevant in sectors such as automotive and healthcare, where user interfaces must adapt to diverse user needs. As these technologies evolve, they are expected to further enhance the capabilities of the GCC embedded graphical user interface development software market.