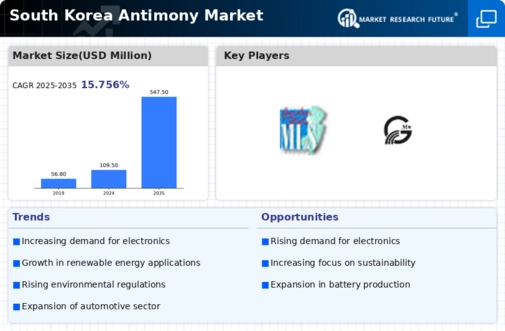

South Korea Antimony Market Summary

As per Market Research Future analysis, the South Korea antimony market Size was estimated at 109.5 USD Million in 2024. The South Korea antimony market is projected to grow from 118.76 USD Million in 2025 to 267.6 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 8.4% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The South Korea antimony market is poised for growth driven by technological advancements and rising demand.

- The electronics sector emerges as the largest segment, reflecting a robust demand for antimony-based products.

- Technological advancements in production processes are likely to enhance efficiency and reduce costs in the antimony market.

- The renewable energy technologies segment is anticipated to be the fastest-growing, driven by increasing investments in sustainable solutions.

- Key market drivers include rising industrial applications and a growing focus on recycling, which may bolster domestic production efforts.

Market Size & Forecast

| 2024 Market Size | 109.5 (USD Million) |

| 2035 Market Size | 267.6 (USD Million) |

| CAGR (2025 - 2035) | 8.46% |

Major Players

China Minmetals Corporation (CN), Hunan Nonferrous Metals Corporation (CN), Georgian Manganese (GE), Antimony Solutions (US), Korea Zinc Co Ltd (KR), Yunnan Tin Company Limited (CN), Mandalay Resources Corporation (CA), United States Antimony Corporation (US)