Regulatory Compliance

The tightening of regulations concerning hazardous materials is a significant factor influencing the Antimony-Free Film Market. Governments and regulatory bodies are increasingly implementing stringent guidelines to limit the use of toxic substances, including antimony, in consumer products. This regulatory landscape compels manufacturers to seek alternatives that comply with safety standards, thereby driving the demand for antimony-free films. For instance, the European Union's REACH regulation has set high standards for chemical safety, prompting companies to innovate and adapt their product lines. As compliance becomes a necessity, the Antimony-Free Film Market is likely to experience growth, as businesses prioritize the development of safer, compliant materials to meet these evolving regulations.

Technological Innovations

Technological advancements in material science and manufacturing processes are likely to propel the Antimony-Free Film Market forward. Innovations such as improved polymer formulations and enhanced production techniques enable the creation of high-performance films without the use of antimony. These developments not only enhance the quality and durability of the films but also expand their applications across various sectors, including packaging, electronics, and medical devices. The integration of advanced technologies, such as nanotechnology and biopolymers, is expected to further drive the market, as these innovations can lead to superior product characteristics. As a result, the Antimony-Free Film Market may witness a surge in demand, driven by the need for more efficient and sustainable solutions.

Sustainability Initiatives

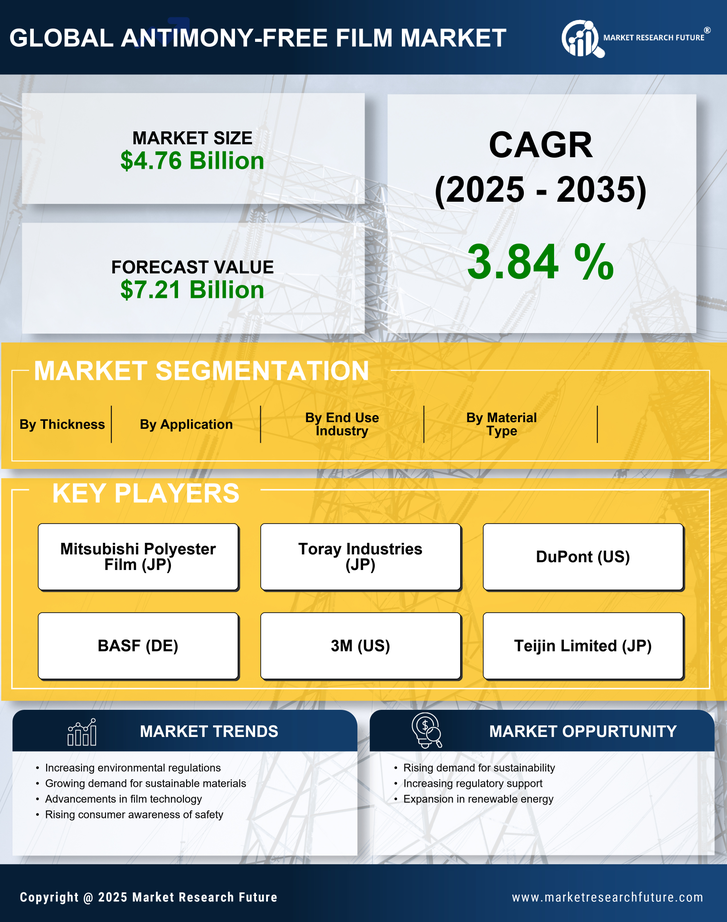

The increasing emphasis on sustainability within various industries appears to be a primary driver for the Antimony-Free Film Market. As consumers and manufacturers alike become more environmentally conscious, the demand for materials that do not contain harmful substances, such as antimony, is likely to rise. This shift is evident in sectors like packaging, electronics, and automotive, where companies are actively seeking alternatives that align with eco-friendly practices. Reports indicate that the market for sustainable materials is projected to grow significantly, with a compound annual growth rate (CAGR) of over 10% in the coming years. Consequently, the Antimony-Free Film Market is poised to benefit from this trend, as businesses strive to meet consumer expectations and regulatory requirements regarding sustainability.

Consumer Awareness and Demand

Rising consumer awareness regarding the health and environmental impacts of materials used in everyday products is a crucial driver for the Antimony-Free Film Market. As consumers become more informed about the potential dangers associated with antimony, they are increasingly favoring products that are marketed as safe and environmentally friendly. This shift in consumer preference is evident in various sectors, including food packaging and electronics, where the demand for antimony-free options is on the rise. Market Research Future indicates that a significant portion of consumers is willing to pay a premium for products that are free from harmful substances. Consequently, the Antimony-Free Film Market is likely to benefit from this heightened consumer demand, as manufacturers respond by offering safer alternatives.

Market Expansion Opportunities

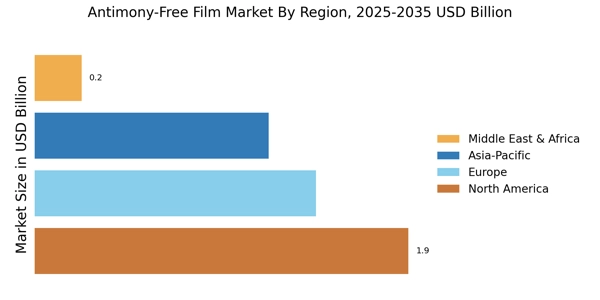

The Antimony-Free Film Market is poised for expansion due to the growing opportunities in emerging markets. As industrialization and urbanization continue to progress in various regions, the demand for packaging and electronic materials is expected to increase. Countries in Asia and Latin America are witnessing a surge in manufacturing activities, which could drive the need for antimony-free films. Additionally, the rise of e-commerce and the subsequent demand for sustainable packaging solutions further enhance the market potential. Reports suggest that the packaging sector alone is projected to grow at a CAGR of 5% over the next few years. Therefore, the Antimony-Free Film Market may capitalize on these expansion opportunities, positioning itself as a key player in meeting the needs of diverse markets.