Expansion of Streaming Services

The proliferation of streaming services in South America is significantly impacting the tv analytics market. With platforms like Netflix, Amazon Prime, and local players gaining traction, the need for robust analytics tools has surged. These services require comprehensive data insights to optimize content offerings and improve user experience. The market is expected to reach a valuation of $1 billion by 2026, reflecting a growing investment in analytics capabilities. Streaming providers are increasingly relying on data-driven strategies to understand viewer behavior, preferences, and trends, thereby enhancing their competitive edge in the rapidly evolving landscape of the tv analytics market.

Rising Demand for Personalized Content

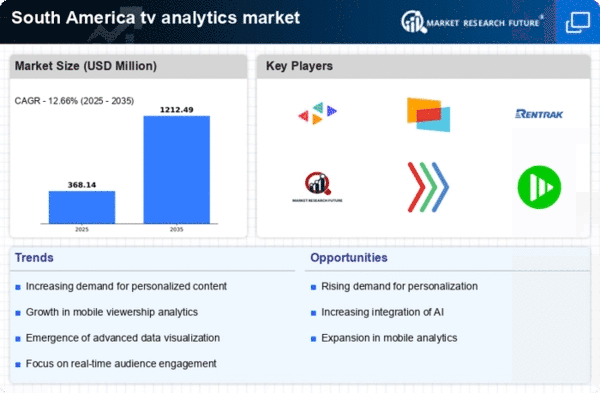

The tv analytics market in South America is experiencing a notable shift towards personalized content, driven by changing viewer preferences. Audiences increasingly seek tailored programming that resonates with their individual tastes. This demand compels broadcasters and streaming services to leverage analytics tools to gather viewer data and preferences. As a result, the industry is projected to grow at a CAGR of approximately 12% over the next five years. By utilizing advanced analytics, companies can enhance viewer engagement and retention, ultimately leading to increased advertising revenues. The ability to deliver personalized experiences is becoming a critical differentiator in the competitive landscape of the tv analytics market.

Increased Investment in Advertising Analytics

In South America, the tv analytics market is witnessing a surge in investment focused on advertising analytics. Advertisers are increasingly recognizing the value of data-driven insights to optimize their campaigns and maximize ROI. As a result, the demand for analytics tools that can measure ad performance and audience engagement is on the rise. The advertising sector is projected to grow by 10% annually, with a significant portion allocated to analytics solutions. This trend indicates a shift towards more strategic advertising approaches, where data plays a pivotal role in decision-making processes within the tv analytics market.

Technological Advancements in Data Collection

Technological advancements are reshaping the data collection landscape within the tv analytics market in South America. Innovations such as smart TVs, mobile applications, and connected devices are enabling more comprehensive data gathering. These technologies facilitate real-time analytics, allowing broadcasters and advertisers to respond swiftly to viewer trends and preferences. The integration of these advanced data collection methods is expected to enhance the accuracy and depth of insights available to stakeholders. As a result, the industry is likely to see a growth rate of around 15% over the next few years, driven by the increasing reliance on technology in the analytics process.

Growing Importance of Viewer Engagement Metrics

In the context of the tv analytics market in South America, viewer engagement metrics are becoming increasingly vital. As competition intensifies among content providers, understanding how audiences interact with programming is essential for success. Metrics such as view duration, interaction rates, and social media engagement are critical for evaluating content effectiveness. This focus on engagement is prompting companies to invest in sophisticated analytics tools that can provide deeper insights into viewer behavior. The emphasis on engagement metrics is likely to drive market growth, with projections indicating a potential increase of 8% in analytics tool adoption over the next few years.