Emergence of Advanced Analytical Tools

The emergence of advanced analytical tools is transforming the landscape of the life science-analytics market in South America. Innovations such as artificial intelligence and machine learning are enabling healthcare organizations to analyze vast amounts of data with unprecedented speed and accuracy. These tools facilitate predictive analytics, which can significantly improve patient outcomes by identifying potential health risks before they escalate. The market for advanced analytics in healthcare is projected to grow by 20% annually, indicating a robust demand for these technologies. As organizations adopt these tools, the life science-analytics market is likely to evolve, offering new opportunities for stakeholders.

Expansion of Biopharmaceutical Research

The life science-analytics market in South America is significantly influenced by the expansion of biopharmaceutical research. With a growing number of biopharmaceutical companies establishing operations in the region, there is an increasing need for advanced analytics to support drug development processes. The biopharmaceutical sector is expected to reach a valuation of $50 billion by 2026, highlighting the potential for analytics to streamline research and development efforts. This expansion necessitates the adoption of sophisticated data analytics tools to manage complex datasets, thereby enhancing the efficiency and effectiveness of biopharmaceutical research in the life science-analytics market.

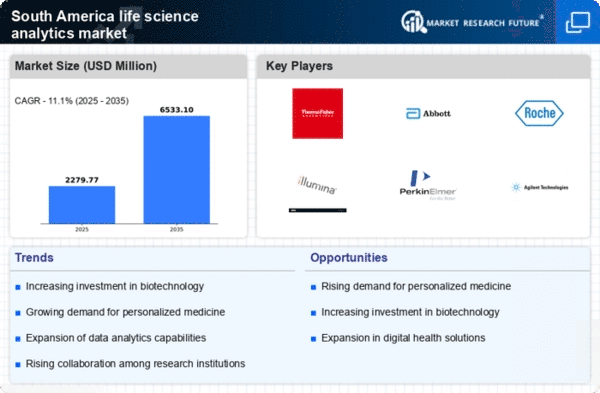

Rising Demand for Personalized Medicine

The life science-analytics market in South America is experiencing a notable surge in demand for personalized medicine. This trend is driven by the increasing recognition of the need for tailored healthcare solutions that cater to individual patient profiles. As healthcare providers and pharmaceutical companies seek to enhance treatment efficacy, the integration of analytics into clinical practices becomes essential. Reports indicate that the market for personalized medicine in South America is projected to grow at a CAGR of approximately 12% over the next five years. This growth is likely to stimulate investments in life science-analytics technologies, enabling better patient outcomes and optimizing resource allocation.

Growing Focus on Data-Driven Decision Making

The life science-analytics market in South America is witnessing a growing focus on data-driven decision making among healthcare providers. As the volume of healthcare data continues to rise, organizations are increasingly recognizing the value of analytics in informing clinical and operational decisions. This shift is likely to enhance patient care and operational efficiency, as data analytics tools provide insights that were previously unattainable. The trend suggests that healthcare institutions may invest up to $2 billion in analytics solutions by 2027, reflecting a commitment to harnessing data for strategic decision making in the life science-analytics market.

Government Initiatives to Boost Healthcare Innovation

Government initiatives aimed at boosting healthcare innovation are playing a crucial role in shaping the life science-analytics market in South America. Various countries in the region are implementing policies that encourage research and development in healthcare technologies. For instance, funding programs and tax incentives are being introduced to support startups and established companies in the life science sector. These initiatives are expected to increase the adoption of analytics solutions, as stakeholders seek to leverage data for improved healthcare delivery. The anticipated growth in government support could lead to a 15% increase in investments in life science-analytics technologies over the next few years.