Rising Healthcare Expenditure

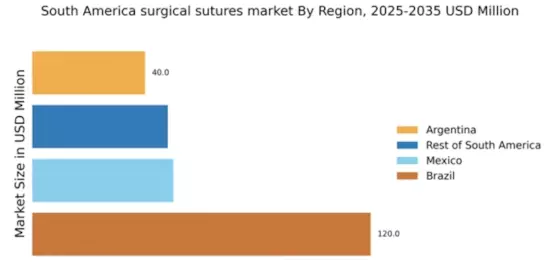

In South America, the surgical sutures market benefits from the increasing healthcare expenditure by both public and private sectors. Governments are investing more in healthcare infrastructure, which includes the procurement of advanced surgical tools and materials. This trend is particularly evident in countries like Brazil and Argentina, where healthcare budgets have seen annual increases of around 8% to 10%. As hospitals and clinics upgrade their facilities, the demand for high-quality surgical sutures rises correspondingly. This investment not only enhances patient care but also stimulates market growth, as healthcare providers seek to adopt the latest technologies and materials in surgical sutures.

Increasing Surgical Procedures

The surgical sutures market in South America experiences growth due to the rising number of surgical procedures performed across various medical specialties. Factors such as an aging population and the prevalence of chronic diseases contribute to this trend. For instance, the demand for surgical interventions in cardiology, orthopedics, and general surgery is on the rise. As healthcare facilities expand their capabilities, the need for reliable and effective suturing solutions becomes paramount. This increase in surgical activity is expected to drive the surgical sutures market, with projections indicating a compound annual growth rate (CAGR) of approximately 6% over the next five years. Consequently, manufacturers are likely to focus on developing innovative suturing products to meet the growing demand.

Growing Awareness of Surgical Safety

The surgical sutures market in South America is influenced by the increasing awareness of surgical safety among healthcare professionals and patients. Initiatives aimed at improving surgical outcomes and reducing complications have gained traction. This heightened focus on safety has led to the adoption of advanced suturing techniques and materials that minimize infection risks and promote faster healing. As a result, healthcare providers are more inclined to invest in high-quality sutures, which are perceived as essential for ensuring patient safety. This trend is likely to propel the market forward, as hospitals prioritize the use of reliable suturing solutions to enhance surgical success rates.

Expansion of Medical Device Regulations

The surgical sutures market is also shaped by the expansion of medical device regulations in South America. Regulatory bodies are increasingly emphasizing the need for stringent quality standards and safety protocols for surgical products. This shift is prompting manufacturers to invest in research and development to ensure compliance with these regulations. As a result, the market is witnessing a surge in the introduction of innovative suturing materials that meet the new standards. This regulatory environment not only enhances product quality but also fosters consumer confidence in surgical sutures, thereby driving market growth. The anticipated regulatory changes are expected to create opportunities for companies that can adapt swiftly to these evolving requirements.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are significantly impacting the surgical sutures market in South America. Innovations such as automated production lines and advanced materials science are enabling manufacturers to produce sutures that are more effective and easier to use. These advancements lead to the development of sutures with enhanced properties, such as improved tensile strength and biocompatibility. As a result, healthcare providers are increasingly adopting these advanced sutures, which are perceived to offer better performance in surgical applications. The ongoing evolution in manufacturing technology is likely to sustain the growth of the surgical sutures market, as companies strive to meet the demands of modern surgical practices.