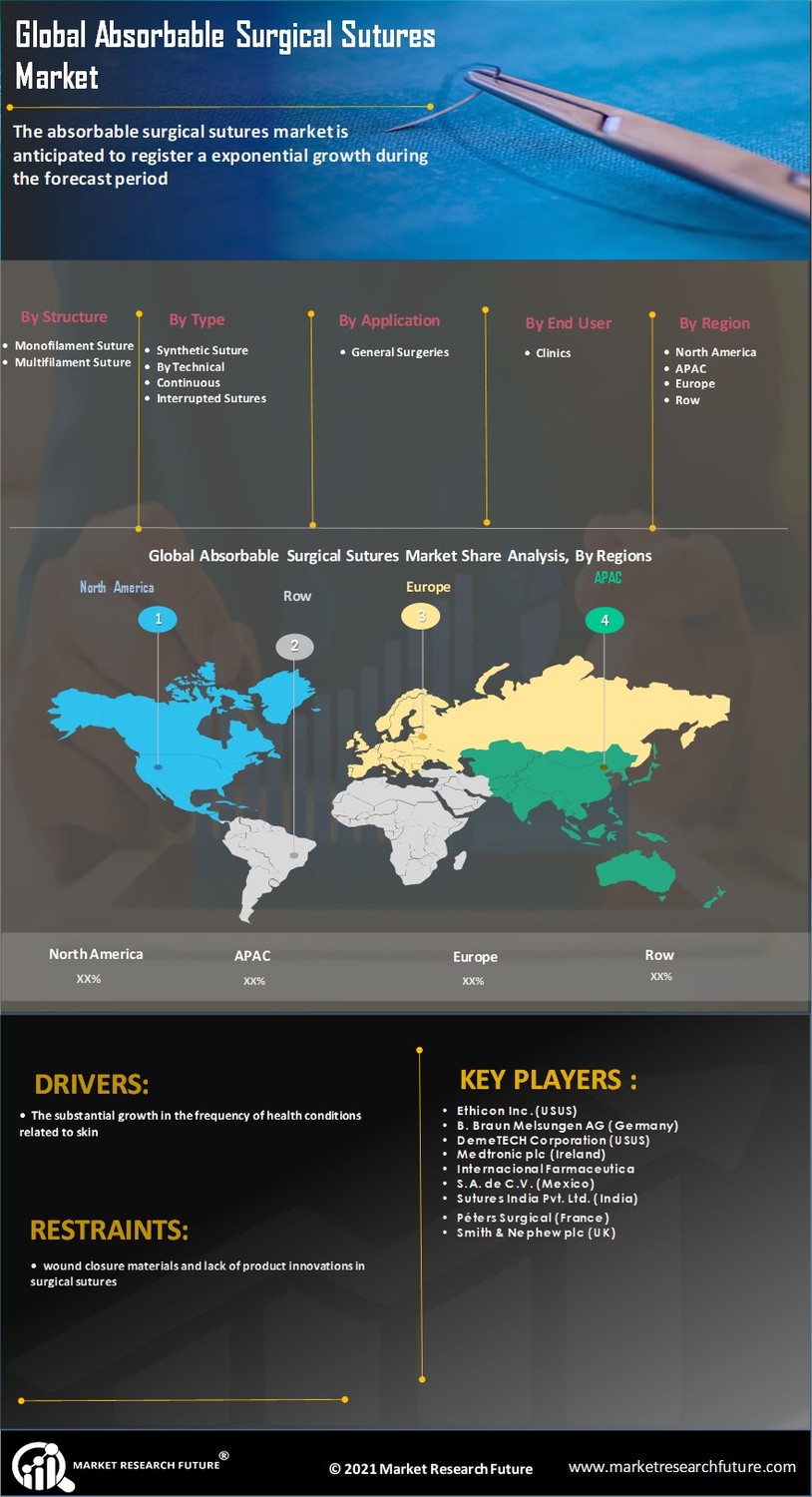

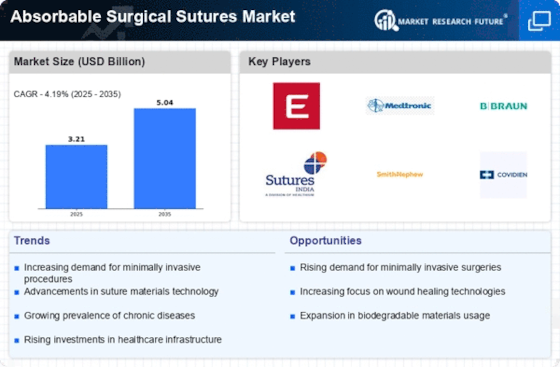

Rising Demand for Surgical Procedures

The increasing prevalence of chronic diseases and the aging population are driving the demand for surgical procedures, thereby propelling the Absorbable Surgical Sutures Market. As more patients undergo surgeries, the need for effective suturing solutions becomes paramount. According to recent data, the number of surgical procedures is projected to rise significantly, with estimates suggesting a growth rate of approximately 6% annually. This trend indicates a robust market for absorbable sutures, which are favored for their ability to dissolve naturally, reducing the need for suture removal and minimizing patient discomfort. The Absorbable Surgical Sutures Market is thus positioned to benefit from this surge in surgical activity, as healthcare providers increasingly opt for these sutures to enhance patient outcomes.

Regulatory Support and Standardization

The Absorbable Surgical Sutures Market is benefiting from enhanced regulatory frameworks that promote the safety and efficacy of surgical products. Regulatory bodies are increasingly focusing on the standardization of absorbable sutures, which helps to ensure consistent quality and performance across the market. This regulatory support not only fosters innovation but also instills confidence among healthcare providers regarding the use of absorbable sutures. As regulations evolve, manufacturers are encouraged to invest in research and development, leading to the introduction of new and improved products. This dynamic environment is likely to drive growth in the Absorbable Surgical Sutures Market, as compliance with stringent standards becomes a key differentiator for market players.

Increasing Awareness of Patient-Centric Care

There is a growing emphasis on patient-centric care within the healthcare sector, which is influencing the Absorbable Surgical Sutures Market. Healthcare providers are increasingly prioritizing patient comfort and satisfaction, leading to a preference for absorbable sutures that reduce the need for follow-up procedures. This shift is supported by data indicating that patient satisfaction scores are positively correlated with the use of absorbable sutures in surgical settings. As awareness of the benefits of these sutures continues to rise, healthcare professionals are likely to adopt them more widely, thereby driving demand in the Absorbable Surgical Sutures Market. This trend reflects a broader movement towards enhancing the overall patient experience in surgical care.

Technological Innovations in Suturing Materials

Advancements in materials science have led to the development of new absorbable sutures that offer improved performance characteristics. Innovations such as the introduction of synthetic polymers and bioengineered materials are enhancing the efficacy of sutures in the Absorbable Surgical Sutures Market. These materials not only provide better tensile strength but also promote faster healing and reduced tissue reaction. The market is witnessing a shift towards sutures that are tailored for specific surgical applications, which could potentially increase their adoption rates. As healthcare professionals become more aware of these advancements, the demand for high-quality absorbable sutures is likely to rise, further stimulating growth in the Absorbable Surgical Sutures Market.

Growing Preference for Minimally Invasive Techniques

The trend towards minimally invasive surgical techniques is reshaping the landscape of the Absorbable Surgical Sutures Market. Surgeons are increasingly adopting these techniques due to their associated benefits, such as reduced recovery times and lower risk of complications. Absorbable sutures are particularly well-suited for these procedures, as they eliminate the need for suture removal and minimize scarring. Market data indicates that minimally invasive surgeries are expected to account for a larger share of surgical procedures in the coming years, which could lead to a corresponding increase in the demand for absorbable sutures. This shift in surgical practice underscores the importance of the Absorbable Surgical Sutures Market in meeting the evolving needs of healthcare providers and patients alike.