Rising Healthcare Costs

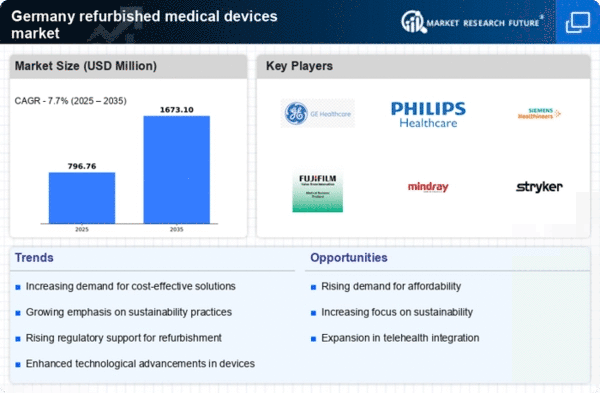

The escalating costs associated with healthcare in Germany are compelling healthcare providers to seek cost-effective solutions. The refurbished medical-devices market presents an attractive alternative, as these devices typically cost 30-50% less than new ones. This price differential allows hospitals and clinics to allocate resources more efficiently, potentially improving patient care. Furthermore, as the demand for medical services continues to rise, the pressure on budgets intensifies. Consequently, the refurbished medical-devices market is likely to experience increased adoption as healthcare facilities strive to balance quality care with financial constraints. This trend indicates a growing recognition of refurbished devices as a viable option, thereby enhancing their market presence.

Technological Advancements

Technological innovations in the refurbishment process are significantly enhancing the quality and reliability of refurbished medical devices. Advanced testing and certification processes ensure that these devices meet stringent safety and performance standards. In Germany, the refurbished medical-devices market benefits from these advancements, as healthcare providers increasingly trust refurbished products. The integration of modern technologies, such as artificial intelligence and machine learning, into refurbishment practices may further improve device functionality and longevity. As a result, the market is likely to see a surge in demand, as healthcare facilities recognize the potential of refurbished devices to deliver high-quality care at reduced costs.

Increased Focus on Sustainability

The growing emphasis on sustainability within the healthcare sector is driving interest in the refurbished medical-devices market. In Germany, healthcare organizations are increasingly aware of their environmental impact and are seeking ways to reduce waste. Refurbished devices contribute to this goal by extending the lifecycle of medical equipment and minimizing electronic waste. This shift towards sustainable practices aligns with broader societal trends, as consumers and organizations alike prioritize environmentally friendly solutions. Consequently, the refurbished medical-devices market is poised for growth, as healthcare providers adopt more sustainable procurement strategies that include refurbished options.

Regulatory Framework Enhancements

The regulatory landscape surrounding medical devices in Germany is evolving, with increased support for refurbished products. Regulatory bodies are implementing clearer guidelines and standards for the refurbishment process, which enhances the credibility of these devices. This regulatory support fosters trust among healthcare providers, encouraging them to consider refurbished options as viable alternatives to new devices. As the refurbished medical-devices market continues to align with regulatory expectations, it is likely to gain traction among healthcare facilities seeking reliable and compliant solutions. This trend suggests a positive outlook for the market as it adapts to the changing regulatory environment.

Growing Demand for Cost-Effective Solutions

The demand for cost-effective medical solutions is on the rise in Germany, particularly among smaller healthcare facilities and private practices. These entities often face budget constraints and are increasingly turning to the refurbished medical-devices market to meet their needs. The affordability of refurbished devices, combined with their reliability, makes them an attractive option for providers looking to maintain high standards of care without incurring excessive costs. As this trend continues, the refurbished medical-devices market is expected to expand, catering to a broader range of healthcare providers seeking economical alternatives.