Advancements in Gene Therapy

Recent advancements in gene therapy are poised to revolutionize the pompe disease-treatment market in South America. Innovative approaches, such as adeno-associated virus (AAV) vectors, are being explored to deliver therapeutic genes directly to affected muscle cells. These advancements could significantly improve treatment outcomes and quality of life for patients. The potential for gene therapy to provide long-lasting effects may attract investment and research funding, further stimulating the market. As the industry evolves, it is anticipated that gene therapy could capture a substantial share of the market, potentially accounting for 30% of total treatment options by 2030.

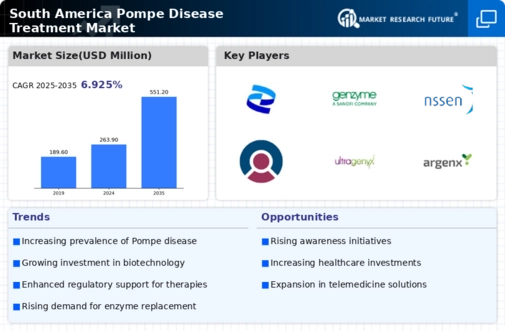

Rising Incidence of Pompe Disease

The increasing incidence of Pompe disease in South America is a critical driver for the pompe disease-treatment market. Recent studies indicate that the prevalence of this rare genetic disorder is on the rise, with estimates suggesting that approximately 1 in 40,000 live births may be affected. This growing patient population necessitates the development and availability of effective treatment options. As healthcare providers become more aware of the disease, the demand for therapies is likely to increase. The pompe disease-treatment market must adapt to this rising incidence by ensuring that innovative therapies are accessible to patients across the region, potentially leading to a market growth rate of 15% annually.

Growing Patient Advocacy and Support Groups

The emergence of patient advocacy and support groups in South America is significantly influencing the pompe disease-treatment market. These organizations play a vital role in raising awareness, providing resources, and advocating for better access to treatments. Their efforts have led to increased visibility of Pompe disease, prompting healthcare providers to prioritize diagnosis and treatment options. As these groups continue to grow, they may facilitate partnerships with pharmaceutical companies, enhancing the development and distribution of therapies. The impact of patient advocacy is likely to be profound, potentially increasing treatment uptake by 20% over the next five years.

Regulatory Support for Innovative Therapies

Regulatory bodies in South America are increasingly supportive of innovative therapies for rare diseases, including Pompe disease. This favorable regulatory environment encourages pharmaceutical companies to invest in research and development, expediting the approval process for new treatments. Initiatives such as fast-track designations and priority review pathways are being implemented to facilitate quicker access to therapies. As a result, the pompe disease-treatment market is likely to see a rise in the number of approved therapies, enhancing treatment options for patients. This regulatory support could lead to a market expansion of approximately 25% by 2028.

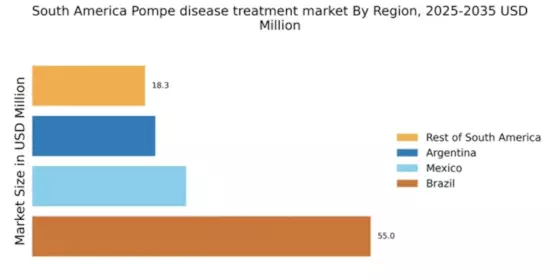

Increased Investment in Rare Disease Research

The pompe disease-treatment market is experiencing a surge in investment focused on rare disease research. Governments and private entities in South America are recognizing the need for targeted therapies for conditions like Pompe disease. This influx of funding is likely to accelerate the development of new treatments and improve existing ones. For instance, the Brazilian government has allocated approximately $10 million to support research initiatives aimed at rare diseases, including Pompe. This financial commitment is expected to enhance collaboration between academic institutions and pharmaceutical companies, fostering innovation and potentially leading to a more robust treatment landscape.