Rising Healthcare Expenditure

The increasing healthcare expenditure in the GCC region is positively influencing the pompe disease-treatment market. As governments prioritize healthcare spending, there is a growing emphasis on providing advanced treatment options for rare diseases. This trend is likely to enhance access to therapies for patients with Pompe disease, thereby expanding the market. Reports suggest that healthcare spending in the GCC is expected to grow by 10% annually, which could lead to improved healthcare infrastructure and increased availability of treatment options. This financial commitment is essential for fostering innovation and ensuring that patients receive the necessary care.

Investment in Rare Disease Research

The growing focus on rare diseases, including Pompe disease, is driving investment in the pompe disease-treatment market. Governments and private organizations in the GCC are increasingly allocating funds for research initiatives aimed at developing new therapies. This trend is supported by the recognition of the unmet medical needs of patients suffering from rare diseases. The market could see an influx of innovative treatment options, as funding for clinical trials and research projects is projected to increase by 30% in the coming years. This investment is crucial for advancing the understanding and treatment of Pompe disease.

Enhanced Genetic Testing Capabilities

Advancements in genetic testing technologies are significantly impacting the pompe disease-treatment market. The introduction of more sophisticated and accessible genetic testing methods allows for earlier and more accurate diagnosis of Pompe disease. This is particularly relevant in the GCC, where healthcare systems are increasingly integrating genetic testing into routine care. As a result, the market is likely to experience a surge in demand for treatments, as early diagnosis can lead to timely interventions. The potential for genetic testing to identify carriers and affected individuals may increase the market size by an estimated 20% over the next few years.

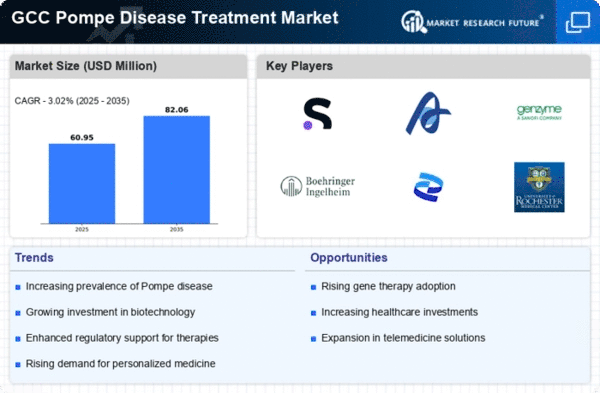

Increasing Prevalence of Pompe Disease

The rising incidence of Pompe disease in the GCC region is a critical driver for the pompe disease-treatment market. Recent studies indicate that the prevalence of this rare genetic disorder is gradually increasing, leading to heightened demand for effective treatment options. As healthcare providers become more aware of the disease, the number of diagnosed cases is expected to rise, which could potentially lead to a market growth of approximately 15% annually. This growing patient population necessitates the development and availability of innovative therapies, thereby stimulating investment in research and development within the pompe disease-treatment market.

Collaboration Between Pharmaceutical Companies

Strategic partnerships and collaborations among pharmaceutical companies are emerging as a significant driver in the pompe disease-treatment market. These alliances facilitate the sharing of resources, knowledge, and technology, which can accelerate the development of new therapies. In the GCC, several companies are joining forces to enhance their research capabilities and expand their product portfolios. This collaborative approach may lead to the introduction of novel treatment options, potentially increasing market competition and driving down costs for patients. The impact of these collaborations could result in a market growth rate of around 12% over the next few years.