Germany Pompe Disease Treatment Market Summary

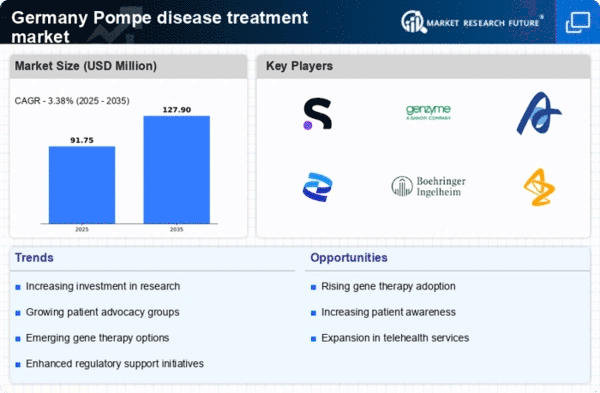

As per Market Research Future analysis, the Germany Pompe Disease Treatment Market size was estimated at 88.75 USD million in 2024. The Pompe Disease-treatment market is projected to grow from 91.75 USD Million in 2025 to 127.9 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 3.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Germany pompe disease-treatment market is experiencing notable advancements and increasing support for innovative therapies.

- Advancements in Enzyme Replacement Therapy are driving the market towards more effective treatment options.

- Regulatory support for innovative therapies is enhancing the approval process for new treatments in Germany.

- Increased patient advocacy and awareness are contributing to a growing demand for treatment options.

- The rising prevalence of Pompe disease and technological innovations in treatment are key drivers of market growth.

Market Size & Forecast

| 2024 Market Size | 88.75 (USD Million) |

| 2035 Market Size | 127.9 (USD Million) |

| CAGR (2025 - 2035) | 3.38% |

Major Players

Sanofi (FR), Genzyme (US), Amicus Therapeutics (US), Pfizer (US), Boehringer Ingelheim (DE), AstraZeneca (GB), Roche (CH), Novartis (CH)