Increasing Energy Needs

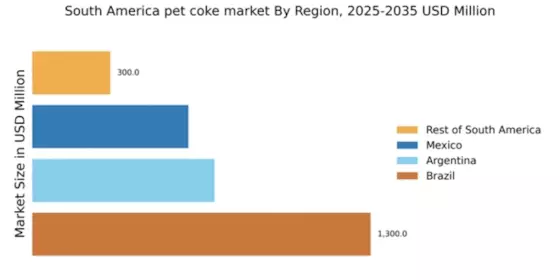

The growing energy demands in South America are driving the pet coke market. As countries in the region continue to industrialize, the need for reliable and cost-effective energy sources becomes paramount. Pet coke, known for its high calorific value, is increasingly being utilized in power generation and industrial applications. In 2025, the energy consumption in South America is projected to rise by approximately 3.5% annually, leading to a heightened interest in pet coke as a viable fuel option. This trend is particularly evident in Brazil and Argentina, where energy shortages have prompted a shift towards alternative fuels, including pet coke. The pet coke market is likely to benefit from this increasing energy demand, as it offers a competitive alternative to traditional fossil fuels.

Rising Export Opportunities

Rising export opportunities for pet coke from South America are significantly impacting the market. As global demand for pet coke increases, particularly from Asia and Europe, South American producers are well-positioned to capitalize on this trend. The region's strategic location and established shipping routes facilitate the export of pet coke to international markets. In 2025, exports of pet coke from South America are projected to grow by 7%, driven by the increasing need for alternative fuels in various industries. Countries like Brazil and Argentina are enhancing their production capacities to meet this demand, thereby strengthening their positions in The pet coke market. This export potential not only boosts local economies but also reinforces the significance of pet coke as a key energy resource.

Expansion of Steel Production

The expansion of the steel production sector in South America is significantly influencing the pet coke market. Countries like Brazil and Chile are ramping up their steel manufacturing capabilities to meet both domestic and international demand. Pet coke serves as a crucial input in the steelmaking process, particularly in the production of metallurgical coke. In 2025, the steel production in South America is expected to grow by around 4%, which could lead to an increased consumption of pet coke. This growth is driven by infrastructure projects and urbanization efforts across the region. As the steel industry continues to flourish, the pet coke market is poised to experience substantial growth, driven by the rising demand for this essential raw material.

Investment in Petrochemical Sector

Investment in the petrochemical sector in South America is emerging as a key driver for the pet coke market. With the region's abundant natural resources, there is a concerted effort to enhance petrochemical production capabilities. Pet coke is utilized as a feedstock in various petrochemical processes, making it an integral component of the industry. In 2025, the petrochemical sector is projected to grow by approximately 5%, leading to an increased demand for pet coke. Countries like Brazil and Venezuela are at the forefront of this investment, aiming to capitalize on their rich hydrocarbon reserves. As the petrochemical industry expands, the pet coke market is likely to see a corresponding rise in demand, further solidifying its position in the energy and materials landscape.

Infrastructure Development Initiatives

Infrastructure development initiatives across South America are playing a pivotal role in shaping the pet coke market. Governments are investing heavily in transportation, energy, and urban infrastructure projects, which require substantial amounts of energy and materials. Pet coke, with its high energy content, is increasingly being used in construction and manufacturing processes. In 2025, infrastructure spending in South America is anticipated to increase by 6%, creating a favorable environment for the pet coke market. This surge in infrastructure projects is particularly pronounced in countries like Colombia and Peru, where urbanization is driving demand for construction materials. As these initiatives progress, the pet coke market is expected to benefit from the heightened demand for energy-intensive materials.