Rising Demand for Real-Time Analytics

The high performance-data-analytics-hpda market experiences a notable surge in demand for real-time analytics solutions. Organizations across various sectors are increasingly recognizing the value of immediate data insights to enhance decision-making processes. This trend is particularly pronounced in industries such as finance and healthcare, where timely information can lead to competitive advantages. According to recent estimates, the market for real-time analytics is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the need for businesses to respond swiftly to market changes and customer preferences, thereby propelling the high performance-data-analytics-hpda market forward.

Emphasis on Data-Driven Decision Making

The emphasis on data-driven decision making is reshaping the landscape of the high performance-data-analytics-hpda market. Organizations are increasingly relying on data analytics to guide strategic initiatives and operational improvements. This shift is evident across various sectors, including marketing, finance, and supply chain management, where data insights are leveraged to enhance performance and drive growth. The market is witnessing a transformation as companies prioritize analytics capabilities to remain competitive. It is estimated that organizations adopting data-driven strategies could see a revenue increase of up to 30%, highlighting the critical role of analytics in the high performance-data-analytics-hpda market.

Growing Importance of Predictive Analytics

Predictive analytics is becoming increasingly vital in the high performance-data-analytics-hpda market, as organizations seek to forecast trends and behaviors based on historical data. This approach allows businesses to make informed decisions and optimize operations, thereby enhancing overall efficiency. Industries such as retail and manufacturing are particularly focused on predictive analytics to improve inventory management and customer engagement strategies. The market for predictive analytics is expected to expand significantly, with projections indicating a growth rate of around 20% annually. This trend underscores the necessity for advanced analytics capabilities within the high performance-data-analytics-hpda market.

Increased Investment in Data Infrastructure

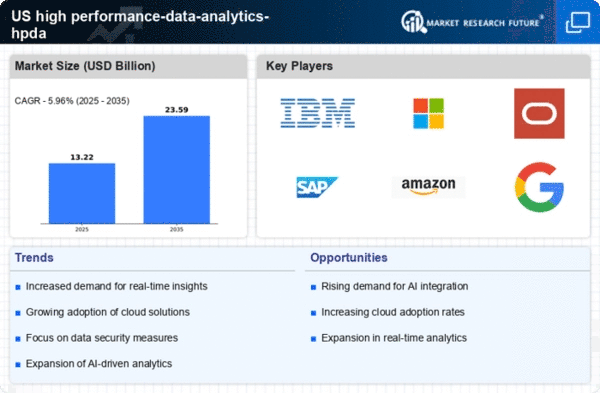

Investment in data infrastructure is a critical driver for the high performance-data-analytics-hpda market. As organizations accumulate vast amounts of data, the need for robust infrastructure to support data storage, processing, and analysis becomes paramount. Companies are increasingly allocating budgets towards upgrading their data centers and adopting cloud solutions to enhance their analytical capabilities. Reports suggest that spending on data infrastructure could exceed $15 billion by 2025, reflecting the growing recognition of data as a strategic asset. This investment trend is likely to bolster the high performance-data-analytics-hpda market, enabling organizations to harness data more effectively.

Advancements in Data Processing Technologies

Technological advancements in data processing are significantly influencing the high performance-data-analytics-hpda market. Innovations such as in-memory computing and distributed processing frameworks are enabling organizations to handle vast amounts of data more efficiently. These technologies facilitate faster data retrieval and analysis, which is crucial for businesses aiming to leverage big data for strategic insights. The increasing complexity of data sets necessitates robust processing capabilities, and as a result, the market is witnessing a shift towards more sophisticated analytics solutions. It is estimated that investments in advanced data processing technologies could reach $10 billion by 2026, further stimulating the growth of the high performance-data-analytics-hpda market.