Increasing Regulatory Requirements

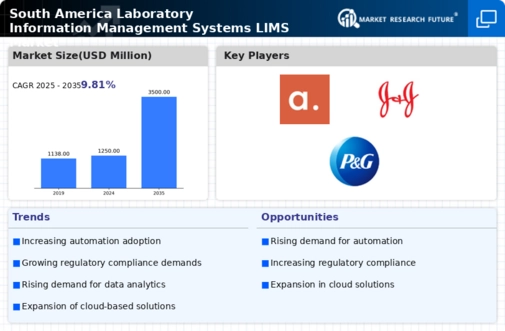

The South America Laboratory Information Management Systems Lims Market is significantly influenced by increasing regulatory requirements. Governments across the region are implementing stricter regulations to ensure quality and safety in laboratory operations. This has led to a heightened demand for LIMS solutions that can assist laboratories in maintaining compliance with these regulations. For example, the introduction of new standards in Brazil has prompted laboratories to adopt LIMS that facilitate accurate reporting and documentation. As regulatory frameworks continue to evolve, the market for LIMS is expected to expand, with a projected growth rate of 9% as laboratories seek to align their operations with compliance mandates.

Growing Demand for Automation in Laboratories

The South America Laboratory Information Management Systems Lims Market is experiencing a notable shift towards automation. Laboratories are increasingly seeking to enhance efficiency and reduce human error through automated processes. This trend is driven by the need for faster turnaround times and improved data accuracy. According to recent data, the automation segment is projected to grow at a compound annual growth rate of approximately 12% in the region. As laboratories adopt LIMS solutions that integrate automation features, the demand for these systems is expected to rise significantly. This shift not only streamlines laboratory operations but also aligns with the broader trend of digital transformation across various sectors in South America.

Focus on Enhanced Data Management Capabilities

In the South America Laboratory Information Management Systems Lims Market, there is a pronounced emphasis on enhanced data management capabilities. Laboratories are increasingly recognizing the importance of efficient data handling, particularly in the context of regulatory compliance and quality assurance. LIMS solutions that offer robust data management features are becoming essential tools for laboratories aiming to maintain high standards. The market is expected to grow as organizations seek to leverage data analytics for better decision-making. This trend is indicative of a broader movement towards data-driven practices in South America, where laboratories are striving to optimize their operations through effective data management.

Rising Investment in Healthcare Infrastructure

The South America Laboratory Information Management Systems Lims Market is benefiting from increased investments in healthcare infrastructure. Governments and private entities are allocating substantial resources to enhance laboratory capabilities, which includes the implementation of advanced LIMS solutions. For instance, Brazil and Argentina have initiated several projects aimed at modernizing laboratory facilities, which is likely to drive the demand for LIMS. The market is projected to witness a growth rate of around 10% as these investments materialize. Enhanced laboratory infrastructure not only improves service delivery but also fosters innovation in research and development, further propelling the adoption of LIMS in the region.

Emergence of Advanced Analytics and Reporting Tools

The South America Laboratory Information Management Systems Lims Market is witnessing the emergence of advanced analytics and reporting tools as a key driver. Laboratories are increasingly seeking LIMS solutions that provide sophisticated analytics capabilities to derive insights from their data. This trend is particularly relevant in the context of research and development, where data-driven decision-making is crucial. The integration of advanced analytics into LIMS is expected to enhance operational efficiency and improve research outcomes. As laboratories in South America adopt these innovative tools, the market is likely to experience a growth trajectory of approximately 11%, reflecting the increasing importance of data analytics in laboratory settings.